In a significant development in the ongoing US tariff war with Asian countries, President Donald Trump has announced a trade agreement with Indonesia. Under this agreement US will now impose 19% tariffs on Indonesian goods, instead 32%, which was planned earlier. This is in exchange for Indonesia’s commitment to purchase billions of dollars in U.S. energy and agricultural products. Export Genius with US trade data and Indonesia trade data would put some light on how this move will transform bilateral trade relations between the US and Indonesia in this detailed blog.

Quick Update

Just over a week after threatening a 32% tariff on Indonesian imports—set to go into effect on August 1—Donald Trump announced a landmark preliminary trade agreement with President Prabowo Subianto. Under the deal:

- Indonesia will impose 19% tariffs on goods entering the U.S.

- The U.S. will lift all tariffs and non-tariff barriers on American goods shipped to Indonesia.

Mutual Commitments

In exchange, Indonesia has pledged:

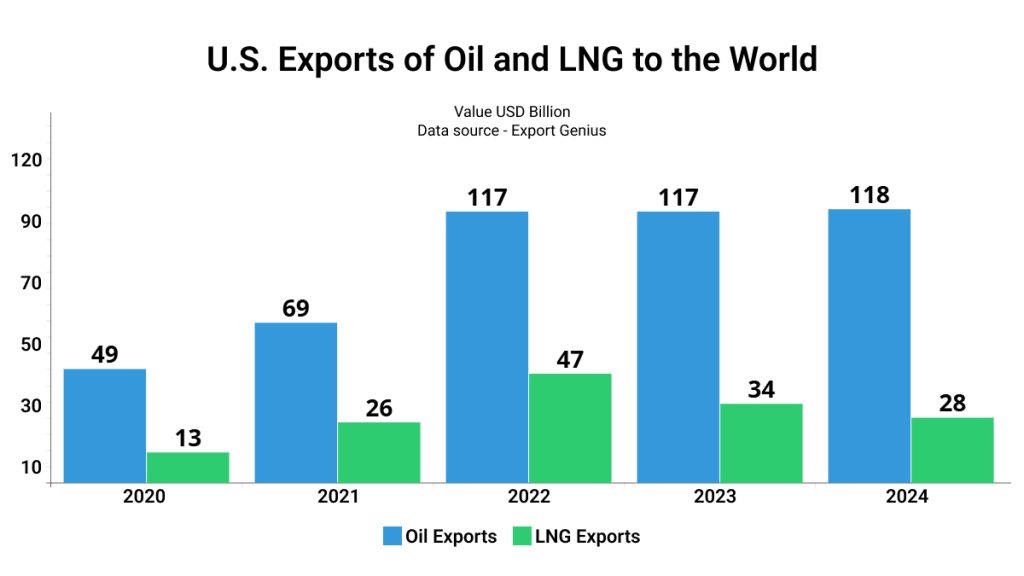

- $15 billion in American energy product purchases (e.g., oil, natural gas). Let’s US export data of oil and LNG for in-depth insights.

| Year | Oil Exports | LNG Exports |

| 2020 | 49 | 13 |

| 2021 | 69 | 26 |

| 2022 | 117 | 47 |

| 2023 | 117 | 34 |

| 2024 | 118 | 28 |

*****Value USD Billion

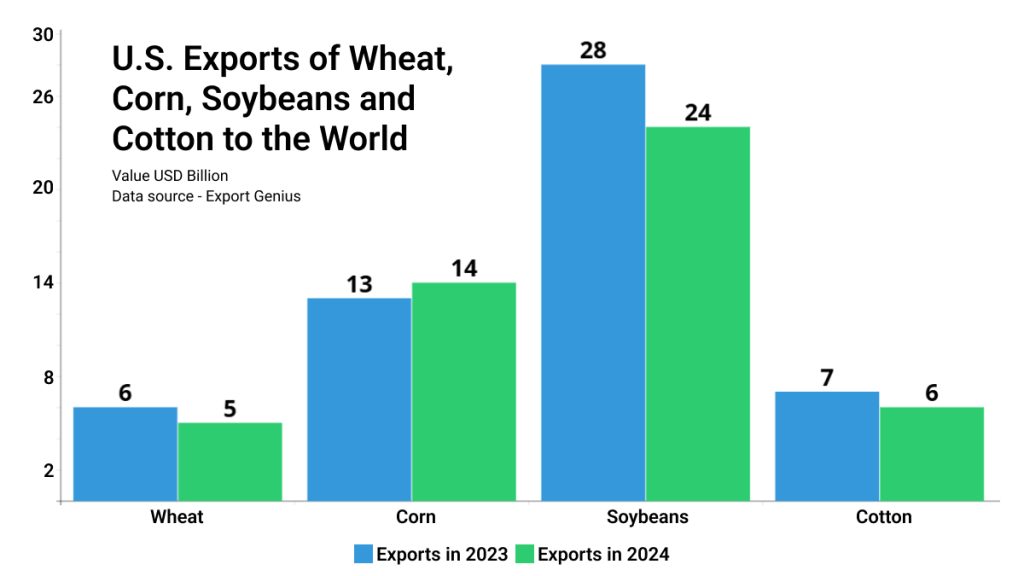

- $4.5 billion in U.S. agricultural commodities like wheat, corn, soybeans, and cotton. This chart and table contain US export statistics of major commodities.

| Commodity | Exports in 2023 | Exports in 2024 |

| Wheat | 6 | 5 |

| Corn | 13 | 14 |

| Soybeans | 28 | 24 |

| Cotton | 7 | 6 |

*****Value USD Billion

Meanwhile, U.S. exporters will enjoy tariff-free access to Indonesia’s 290‑million‑strong market.

Strategic & Economic Impacts

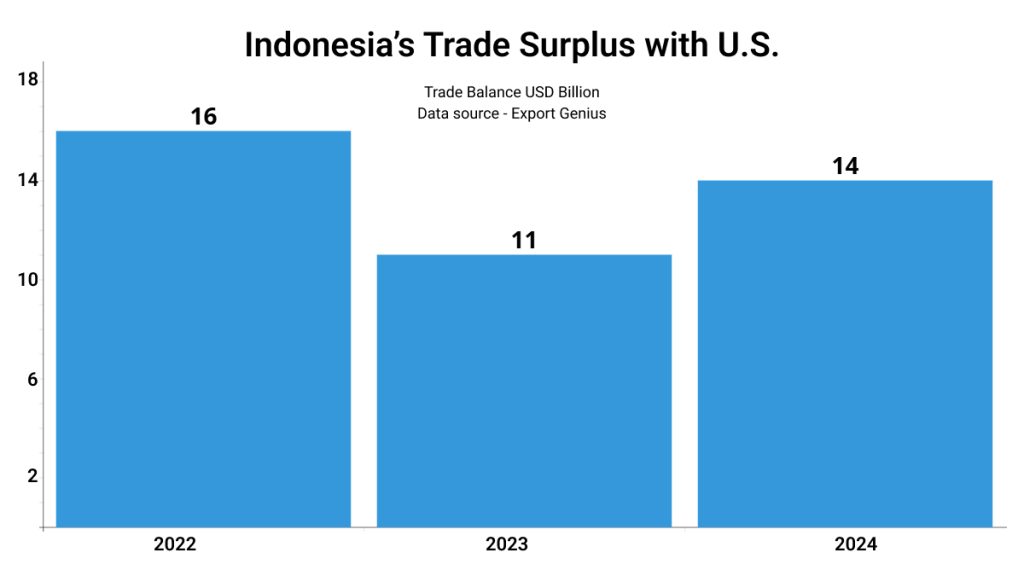

U.S. Trade Balance: Indonesia holds a roughly $14 billion trade surplus with the U.S. (2024), driven by exports like apparel, palm oil, and electronics. Trump’s strategy “aims to correct tariff asymmetries” by making U.S. tariffs reciprocal.

| Year | Trade Balance USD Billion |

| 2022 | 16 |

| 2023 | 11 |

| 2024 | 14 |

Global Tariff Campaign: This deal follows similar pacts with the UK, Vietnam, and tentative talks with China and India, ahead of sustained tariff escalation slated for August 1.

Inflation Signals: With June’s CPI at 2.7%, critics caution the tariffs may raise consumer prices domestically.

Regional Reactions: EU officials are reportedly considering retaliatory tariffs (approx. $84 billion worth of U.S. goods) if the U.S. presses forward

Indonesia’s Perspective

Market Confidence: Indonesia’s stock market saw modest gains, and Bank Indonesia—along with some economists—voiced optimism about increased economic momentum and capital inflows.

Ongoing Talks: Jakarta is still clarifying exemptions, particularly for palm oil, nickel, coffee, and rubber. Discussions also cover how U.S. tech goods would mesh with Indonesia’s local-content rules.

Bottom Line

While still in the preliminary stage, Trump’s Indonesia deal marks a strategic pivot in U.S. trade policy—combining tariff leverage with aggressive trade commitments. It not only reshapes bilateral ties with one of Southeast Asia’s largest economies but also signals an ambitious projection of U.S. economic influence in the region. However, pending implementation details and global ramifications suggest the story is far from over.