Reciprocal tariffs have become a significant factor in global trade, especially with the evolving trade policies of the United States. As countries engage in tariff impositions and negotiations, businesses in various industries, particularly those dealing with commodities, face new challenges and opportunities. According to Export Genius, the United States is one of the largest trading partners of Asian countries including India and China. In this blog, we’ll explore the concept of reciprocal tariffs, how they impact trade dynamics, and strategies businesses can use to navigate these changing trade landscapes.

What are reciprocal tariffs?

Reciprocal tariffs are imposed by one country in response to tariffs or trade barriers imposed by another. Essentially, they are retaliatory measures where a country enacts tariffs on imports from another country to match or counterbalance the tariffs placed on its own goods. These tariffs are often used as a tool in trade negotiations to encourage fairer trade practices or to retaliate against unfair trade policies or actions.

US reciprocal tariff – impact 1 – India’s exports of key commodities to hit

Indian companies in consumer electronics, jewelry, and apparel sectors are strategizing with their key US export clients amid threats of reciprocal tariffs from the US starting April 2.

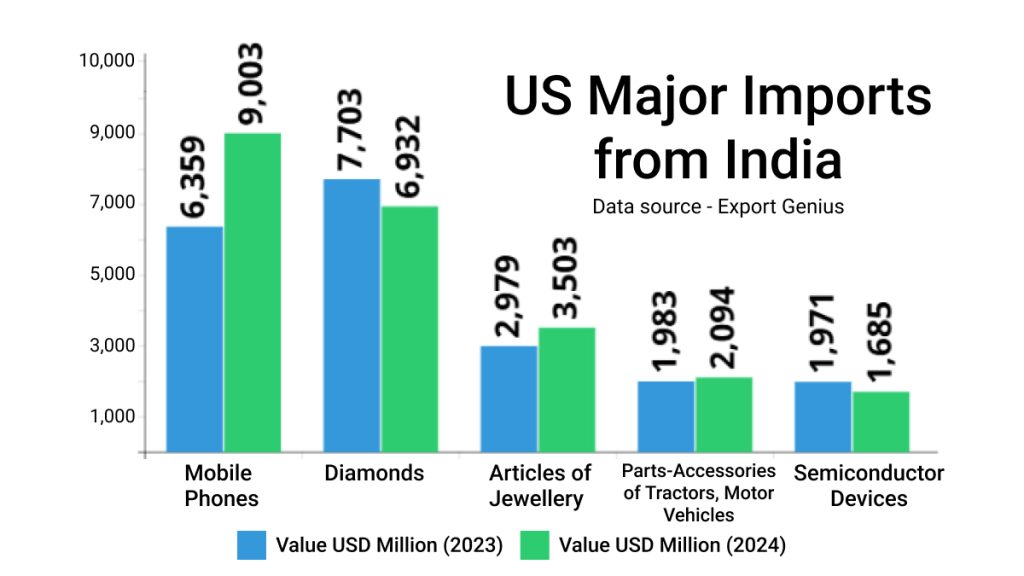

The United States of America is one of the largest trade partners of India. US import data shows America’s imports from India totaled USD 91 billion in 2024, increased from USD 87 billion in 2023.

| Commodity | Value USD Million (2023) | Value USD Million (2024) |

| Mobile Phones | 6,359 | 9,003 |

| Diamonds | 7,703 | 6,932 |

| Articles of Jewellery | 2,979 | 3,503 |

| Parts and Accessories of Tractors, Motor Vehicles, etc. | 1,983 | 2,094 |

| Semiconductor Devices | 1,971 | 1,685 |

*****Commodities are of 4-digit level HS Classification

The Gem & Jewellery Export Promotion Council (GJEPC) is sending a team to the US on March 15 for confidence building and to work out upcoming plans with major clients. The team will meet senior executives of the International Diamond Manufacturers Association, Natural Diamond Council, and Diamond Manufacturers & Importers Association of America.

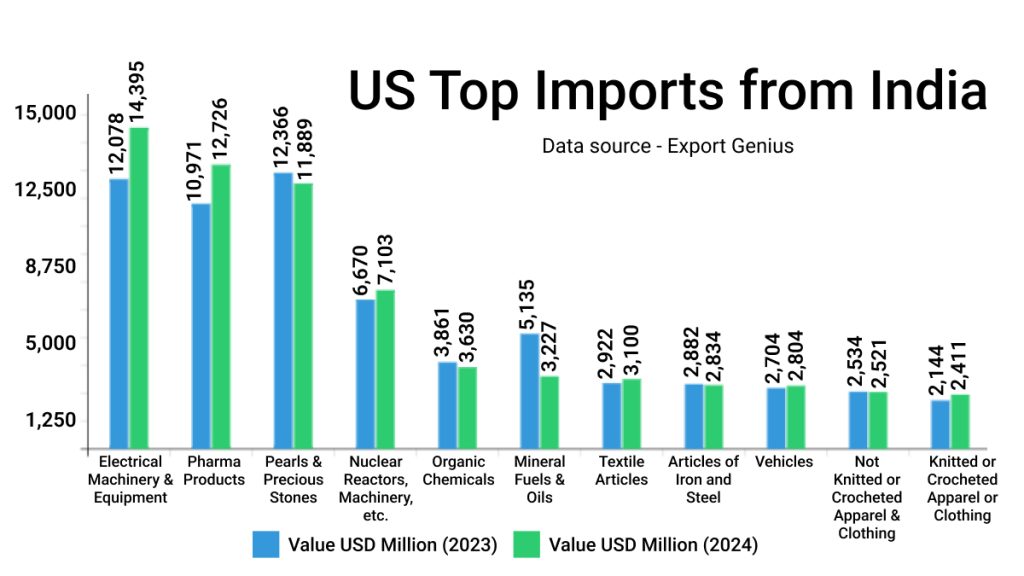

US trade data shows US top import categories from India in 2024 were electrical machinery & equipment, pharma products, pearls & precious stones, nuclear reactors, machinery, etc., organic chemicals, mineral fuels & oils, textile articles, articles of iron & steel, vehicles other than tramway or railway, not knitted or crocheted apparel or clothing, and knitted or crocheted apparel or clothing.

| Import Category | Value USD Million (2023) | Value USD Million (2024) |

| Electrical Machinery & Equipment | 12,078 | 14,395 |

| Pharma Products | 10,971 | 12,726 |

| Pearls and Precious Stones & Metals | 12,366 | 11,889 |

| Nuclear Reactors, Machinery, etc. | 6,670 | 7,103 |

| Organic Chemicals | 3,861 | 3,630 |

| Mineral Fuels & Oils | 5,135 | 3,227 |

| Textile Articles | 2,922 | 3,100 |

| Articles of Iron and Steel | 2,882 | 2,834 |

| Vehicles Other Than Tramway or Railway | 2,704 | 2,804 |

| Not Knitted or Crocheted Apparel & Clothing | 2,534 | 2,521 |

| Knitted or Crocheted Apparel or Clothing | 2,144 | 2,411 |

*****Import categories are of 2-digit level HS Classification

Impact 2 – Trade war puts sales of roughly 12 million tons of US crops under threat

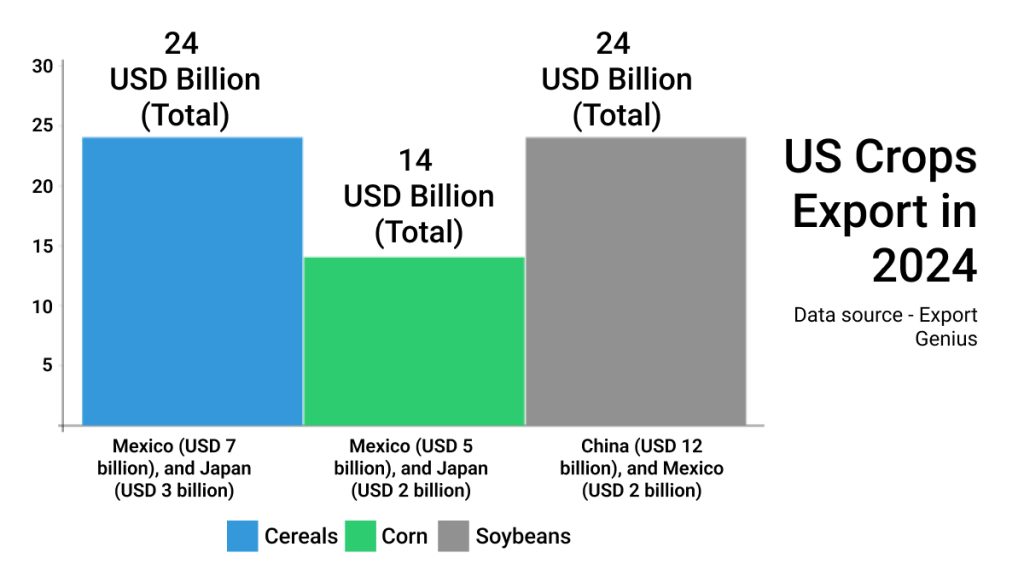

With China and Canada already hitting back against President Donald Trump’s tariffs and concerns over more retaliation in the works, agriculture traders are now watching for potential cancellations on contracts that would put roughly 12 million tons of American crop sales at risk.

Beijing has already enacted countermeasures on a range of agricultural commodities and Canada has also hit back, including on food products. The risk is that Mexico might cancel imports of corn from the United States. Mexico could put their own import tariffs on corn that could reduce the US freight advantage. Mexico is the biggest importer of US cereals, corn, and soybeans. China is also the largest buyer of US soybeans.

| Commodity | Value USD Billion 2024 | Top Export Destinations |

| Cereals | 24 | Mexico (USD 7 billion), and Japan (USD 3 billion) |

| Corn | 14 | Mexico (USD 5 billion), and Japan (USD 2 billion) |

| Soybeans | 24 | China (USD 12 billion), and Mexico (USD 2 billion) |

Impact 3 – After Trump’s tariffs, Mexico seeks Asian and European crude oil buyers

Mexican companies are in talks with potential buyers in Asia, including China, and Europe, as it seeks alternative markets for its crude after U.S. President Donald Trump imposed tariffs on imports.

Trump this week implemented 25% tariffs on goods from Mexico and Canada. While Canadian crude won an exception of a 10% levy, Mexican crude is to be taxed at 25%.

While Mexico does send some crude to Europe and Asia– particularly to India and South Korea, its northern neighbour receives the lion’s share of exports of the flagship heavy sour Maya. The good thing is that there’s appetite for Mexican crude in Europe, in India, in Asia.

Traders have for weeks speculated on whether the world’s most indebted energy company would give a discount to its U.S. clients as it seeks to retain them in the face of tariffs.

Mexico is a major producer but output from the country’s older oil fields, mostly in the Gulf of Mexico, has slumped to more than a four-decade low.

Its ailing domestic refining system and a long-delayed start of the new 340,000 bpd Olmeca refinery in the port of Dos Bocas has left the country exporting crude oil while having to import gasoline and diesel, much of it from the U.S.

Without significant spending on exploration and production, Mexico may even find itself importing crude in the future to feed its expanded refinery capacity in the next decade, a once unfathomable reversal.

While reciprocal tariffs present significant challenges for industries reliant on commodities, companies that embrace strategic planning, market diversification, and adaptability are more likely to successfully navigate these complex trade dynamics. Let’s wait till April 2 when new US tariffs would be imposed on Indian commodities and watch how this US tariff war with China, Mexico, India, Canada, and other countries would impact global trade.

Stay tuned to Export Genius to analyse possible tariff impact on import export commodities by analysing global trade data with company information, commodity details and country’s shipment records.