Did you know that tariffs disrupt global supply chains more than ever before? In early 2025, the global trade landscape is feeling the pressure. After a modest 2.7% recovery in 2024, the World Trade Organization (WTO) now predicts a 1% drop in global merchandise trade volumes for 2025. So, what’s behind this sudden reversal?

According to The Wall Street Journal, a mix of rising tariffs and geopolitical uncertainty is to blame. Take the United States, for instance – it has introduced fresh tariffs on electric vehicles and tech components from Asia, triggering similar moves from trading partners. The ripple effect is global.

In April 2025, the WTO also flagged that more than 3,000 trade-restrictive measures have been implemented worldwide since 2020, with the US, EU, and China leading the list (source: WTO Trade Monitoring Report). These aren’t just stats – they’re signals that global supply chains are being reengineered, rerouted, and, in many cases, disrupted.

Let’s dive into how tariffs disrupt global supply chains and are changing the way the world trades, and why the right data and decisions are more critical than ever.

How Do Tariffs Disrupt Global Supply Chains?

Tariffs are taxes that governments place on imports. On paper, they’re meant to protect local industries by making foreign goods more expensive. But in practice, they can do much more like shift entire supply chains, impact pricing, and even lead to trade wars.

Let’s break it down using real-world data.

Do Higher Tariffs Mean Better Trade Balance? Not Always.

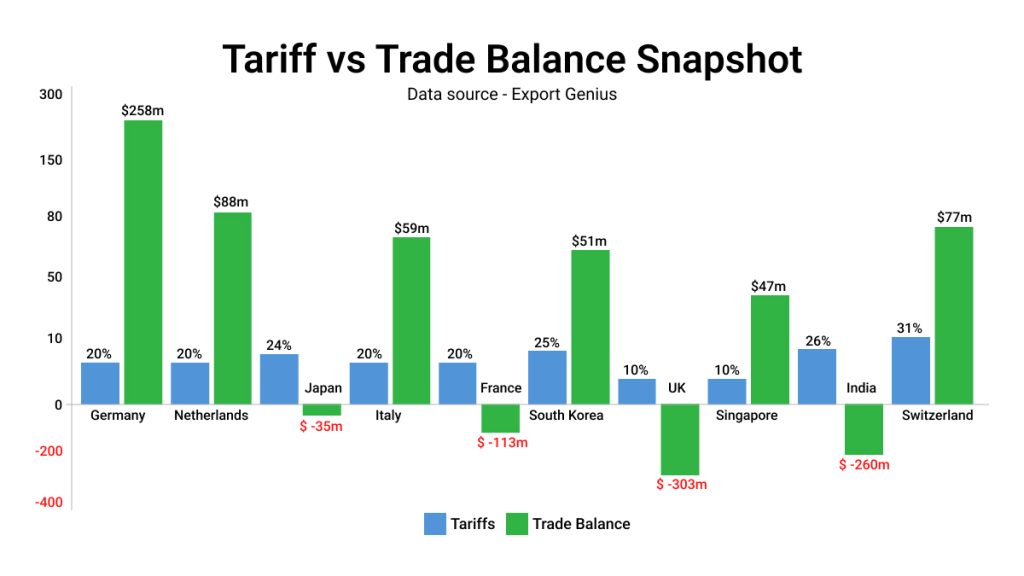

Here’s a snapshot of how major exporting countries (excluding China) are performing under various tariff levels:

Tariff vs Trade Balance Snapshot

High Tariff Countries (24% and above)

Countries: India, Japan, South Korea, Switzerland

Tariff Range: 24%–31%

You’d expect high tariffs to protect domestic industries. But here’s what the numbers say:

- India: -$260 million

- Japan: -$35 million

- South Korea: +$51 million

- Switzerland: +$77 million

Why the difference?

India & Japan depend heavily on imported parts—especially in electronics and machinery. So, high tariffs make components more expensive, raising production costs and hurting exports.

South Korea & Switzerland, on the other hand, are niche leaders in semiconductors and pharma. Their products are in such high demand that even high tariffs can’t dent their competitiveness.

Takeaway:

High tariffs + import dependency = weak exports

High tariffs + specialized strengths = exports stay strong

Moderate Tariffs (Around 20%)

Countries: Germany, Netherlands, Italy, France

- Tariff: 20%

- Germany: +$258 million

- Netherlands: +$88 million

- Italy: +$59 million

- France: -$113 million

Most of these countries manage a positive balance. Why?

They apply moderate tariffs—not too low, not too high. Germany and Italy, with robust manufacturing, manage to protect their industries while staying competitive. France is an exception, likely due to other domestic challenges.

Takeaway:

Moderate tariffs = strategic balance

Low Tariffs (10% or Less)

Countries: United Kingdom, Singapore

- Tariff: 10%

- Singapore: +$47 million

- United Kingdom: -$303 million

Singapore thrives as a trade hub with excellent logistics and low tariffs. The UK, post-Brexit, is still struggling with disrupted supply chains—even with low tariffs.

Takeaway:

Low tariffs help trade hubs, but not enough if domestic production is weak

The Bigger Picture: One Size Doesn’t Fit All

There’s no universal rule when it comes to tariffs. Their impact depends on:

- How much a country imports to produce exports

- The strength of its local industries

- Its position in global trade networks

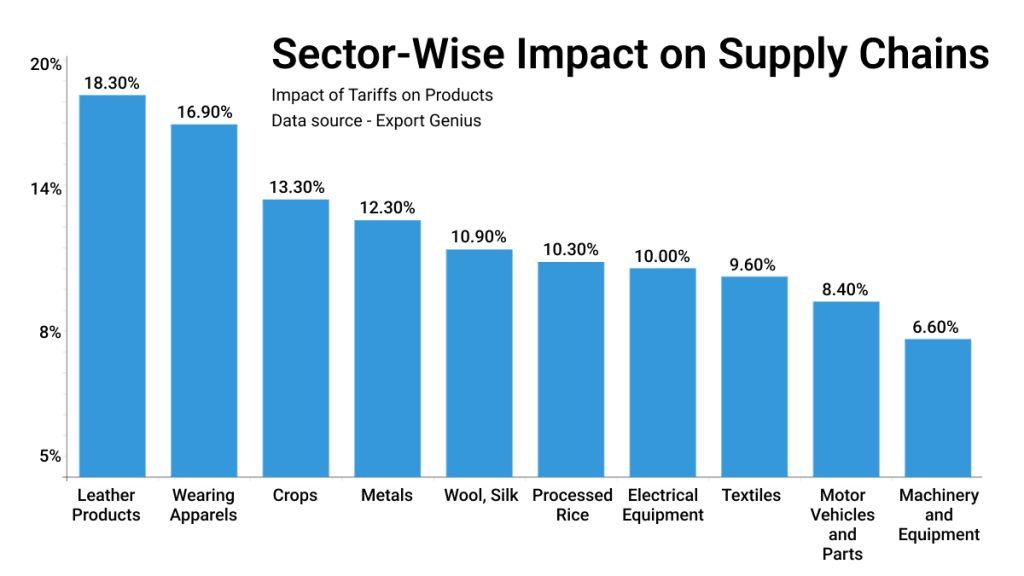

Sector-Wise Impact on Supply Chains

Tariffs do not affect every industry the same way. Some sectors feel the pressure more, either through higher costs, supply delays, or changing where they get their materials from.

Let’s break it down industry wise so that it becomes easy to understand where the tariffs hit hardest and how companies are adapting, in today’s supply chains.

1. Consumer Goods – Leather, Apparel, Textiles, Wool & Silk

These are the everyday products we wear and use.

- Tariffs on these products are among the highest, with leather goods facing up to 18.3% extra cost.

- When tariffs go up, brands have two choices. Either to absorb the extra cost that cuts off the profit or raise prices for consumers.

- Higher prices usually mean shoppers start buying less, or they look for cheaper alternatives.

How Companies Are Responding:

Brands are moving their production to lower-tariff countries like Vietnam or Bangladesh. This helps them keep costs down and stay competitive.

Supply chains are diversifying, with new manufacturing hubs emerging around the world.

2. Agriculture & Food Products – Crops and Processed Rice

This is the stuff that ends up on our plates.

- Tariffs here range from 10% to 13.3%, which can make a big difference in food prices, especially in international markets.

- When it costs more to export food, farmers and producers might sell less abroad and focus more on their home markets.

- For perishable goods like fresh produce or rice, even small delays at the border due to tariffs can cause spoilage or waste.

What’s Changing:

Producers are changing what they grow based on profitability or turning to domestic markets to avoid complex export hurdles.

In many cases, food supply chains become slower and more complicated, especially if countries respond with their own tariffs in return.

3. Industrial Goods – Metals, Machinery, Motor Vehicles

These are the building blocks of bigger industries—factories, construction, and cars.

- Tariffs on metals are around 12.3%, and for machinery and vehicles, they range from 6.6% to 8.4%.

- These goods are often used as inputs for other products. So when their prices go up, it ripples down the entire supply chain.

- For example, if it costs more to import steel, then everything from cars to washing machines gets more expensive to make.

How Companies Are Responding:

Some are trying to move manufacturing closer to home (reshoring)

Diversifying supplier network in countries with fewer trade barriers. However, shifting an industrial supply chain takes time, money, and a lot of planning.

4. Electronics – Electrical Equipment

Think computers, smartphones, cables, chargers – pretty much everything we rely on a daily basis.

- Tariffs here are around 10%, which might not sound like a lot, but in the electronics world, even a small price increase can have a big impact.

- Electronics manufacturing relies on hundreds of tiny parts from multiple countries. So if even one component gets expensive or delayed, it can slow down entire production lines.

What’s Changing:

To avoid being caught off guard as tariffs disrupt global supply chains, companies are increasingly investing in regional setups – boosting capacity in Southeast Asia, Eastern Europe, and beyond. The goal? Reduce overdependence on any single country and stay resilient amid trade and political uncertainties.

Why This Matters

Tariffs disrupt global supply chains, and that’s pushing companies across industries to rethink how and where they operate.

Here’s what they’re doing:

- Shifting production to other countries

- Looking for new suppliers

- Redesigning products with more affordable materials

- Putting more money into local or regional manufacturing

It’s not just about cutting extra costs—it’s also about staying strong, flexible, and competitive in a world where trade rules keep changing.

Real-Time Challenges for Businesses

- Rising tariffs = higher costs for both imports and exports

- Supply chains are under restructuring pressure

- Trade balances are unpredictable

- Sourcing and logistics decisions are harder than ever

So how do you stay ahead in this ever-changing game?

The Export Genius Advantage

Export Genius helps you see what’s coming and act faster. With real-time trade data, you can:

Track shifting supply chains

- Spot emerging sourcing countries like Vietnam or Mexico

- Monitor trade volumes by industry

Find reliable trade partners

- Get verified supplier and buyer lists

- See what competitors are trading, with whom, and how much

Analyze trends & adjust strategy

- Follow tariff impacts across industries

- See where trade is rising—or slowing

Whether you’re a manufacturer, exporter, supply chain leader, or policymaker, Export Genius gives you the insight to stay competitive, avoid blind spots, and seize opportunities in global trade.

Use Export Genius to guide your next move in global trade – because in today’s world, data isn’t just helpful, it’s essential.

Start your journey with Export Genius today!

FAQs

1. What is the impact of tariffs on the supply chain?

Tariffs raise the cost of imported materials, making production more expensive. This can delay manufacturing, disrupt supplier relationships, and force companies to shift operations to different countries.

2. How do tariffs affect the shipping industry?

Tariffs can reduce international trade volume, meaning fewer goods are shipped. This affects demand for cargo space, increases idle capacity at ports, and may lead to rerouted or longer shipping paths.

3. How do tariffs affect supply and demand curves?

Tariffs raise prices, so demand drops (demand curve shifts left). They also raise production costs, reducing supply (supply curve shifts left). The result: higher prices and lower quantities in the market.

4. How does a tariff shift the supply curve?

Tariffs make inputs more expensive, so businesses produce less. This shifts the supply curve to the left, meaning lower supply at the same price and higher prices for consumers.

5. What kind of data can help companies navigate tariff challenges?

Companies need trade intelligence on tariff rates by product and country, historical import/export patterns, and supplier shifts. Export Genius provides all of this to help businesses plan smarter supply chain strategies.