India’s crude oil import patterns are undergoing a strategic shift. According to the latest trade data, India’s Russian oil imports decreased by 8.4% year-over-year during April–September 2025, reflecting shifting market dynamics, narrowing price discounts, and evolving geopolitical pressures. While Russia remains a key energy partner, its share in India’s total crude basket slipped to around 36%, down from nearly 40% a year earlier.

This decline isn’t just about numbers — it signals a broader realignment of India’s energy sourcing strategy, with refiners shifting their focus toward the Middle East and the U.S. for more flexible and secure supplies.

Access accurate and real-time trade intelligence with Export Genius — your trusted source for oil import-export data, market trends, and customs insights to make informed business decisions in a fast-changing energy landscape.

Recent trade data shows that India’s crude oil imports from Russia declined 8.4% year-on-year during the April to September period of 2025. This shift points to deeper changes in India’s energy sourcing, geopolitics, and refinery decisions. Let’s dig into the numbers, drivers, implications — and what to watch going forward.

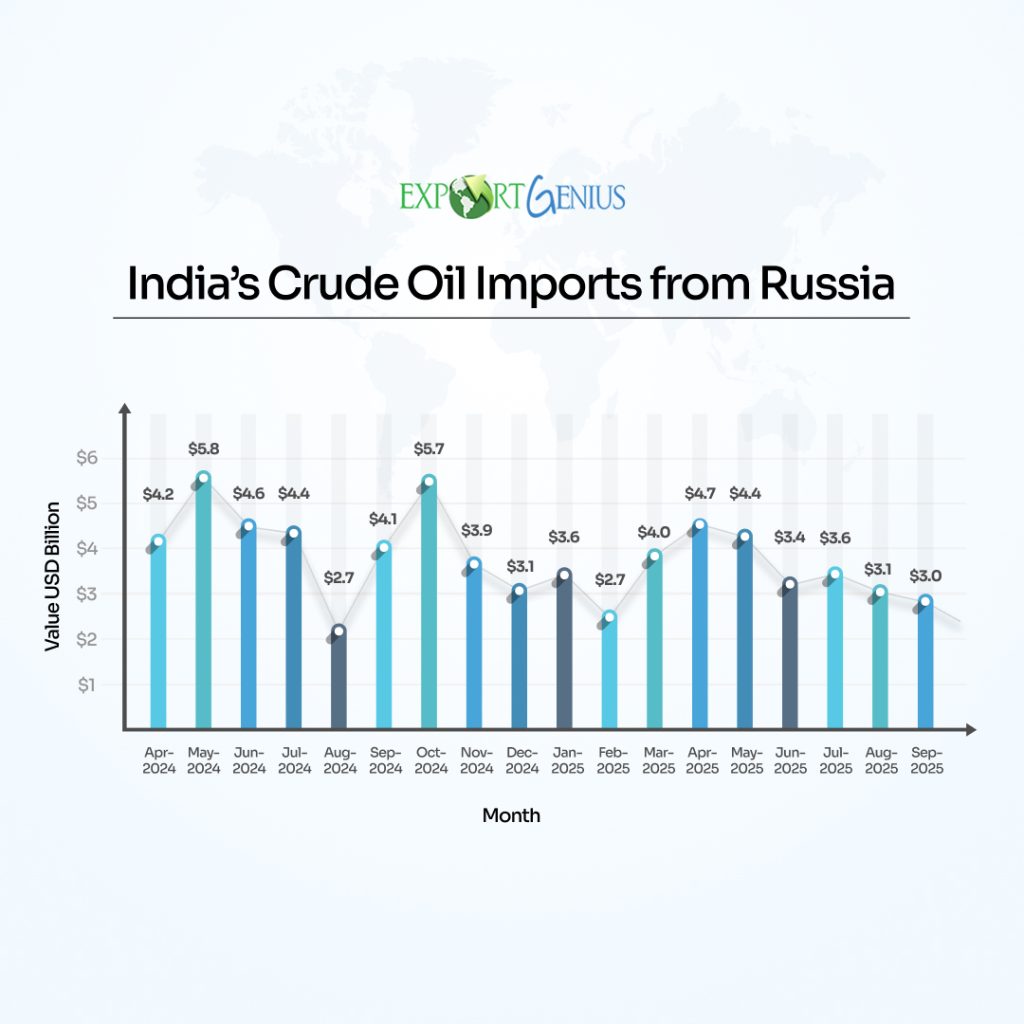

| Month | Value USD Billion |

| Apr-2024 | 4.2 |

| May-2024 | 5.8 |

| Jun-2024 | 4.6 |

| Jul-2024 | 4.4 |

| Aug-2024 | 2.7 |

| Sep-2024 | 4.1 |

| Oct-2024 | 5.7 |

| Nov-2024 | 3.9 |

| Dec-2024 | 3.1 |

| Jan-2025 | 3.6 |

| Feb-2025 | 2.7 |

| Mar-2025 | 4.0 |

| Apr-2025 | 4.7 |

| May-2025 | 4.4 |

| Jun-2025 | 3.4 |

| Jul-2025 | 3.6 |

| Aug-2025 | 3.1 |

| Sep-2025 | 3.0 |

Why India’s Russian Oil Imports Are Falling

Shrinking Discounts

Early in the Ukraine conflict, Russian crude offered steep discounts compared to Brent. Those discounts have narrowed significantly, reducing the economic incentive for Indian refiners.

Geopolitical Pressures

India faces growing pressure from the U.S. and its allies to limit purchases of Russian oil. This has indirectly influenced trade decisions, especially for public sector refiners.

Strategic Diversification

India is increasing imports from the Middle East and the U.S., aiming to reduce overdependence on any one region.

Logistical & Regulatory Risks

Sanctions on shipping, insurance, and payments have added layers of risk and cost to Russian oil imports.

Operational Adjustments

Heavier Russian crude grades are less economical when discounts shrink, leading refiners to favor lighter, more compatible Middle Eastern grades.

Rebalancing Toward Middle East and U.S. Crude

While Russia’s share in India’s crude basket declined to 36%, OPEC suppliers increased their share from 45% to 49% over the same period.

Middle Eastern producers now account for about 45% of India’s total imports, up from 42% last year.

Meanwhile, U.S. crude shipments to India rose 6.8% year-on-year in April–September 2025, reflecting deeper energy ties between New Delhi and Washington.

Implications for India and Global Oil Markets

Energy Security: Diversification strengthens India’s resilience against geopolitical shocks.

Refining Margins: Narrower discounts could squeeze margins, especially for state refiners.

Trade Balance: Shifting from discounted Russian barrels to costlier alternatives may widen India’s oil import bill.

Diplomatic Balancing: India continues to walk a tightrope between strategic autonomy and Western trade pressure.

Market Signal to Russia: Reduced Indian demand may push Moscow to offer deeper discounts or seek other buyers.

What to Watch Ahead

- Further price or discount changes on Russian crude

- Policy or sanctions developments from the U.S. and EU

- Refinery capacity upgrades and crude flexibility

- Alternative supplier competition — Middle East, U.S., Africa

- Seasonal demand and monsoon impacts on imports

Conclusion

India’s 8.4% drop in Russian oil imports between April and September 2025 highlights more than just a shift in trade volumes — it reflects a calculated energy strategy driven by pricing trends, geopolitical pressures, and the need for supply security. As Russian discounts narrow and global dynamics evolve, India is diversifying its crude basket, increasing reliance on Middle Eastern and U.S. suppliers while carefully balancing diplomatic ties.

For energy companies, traders, and policymakers, understanding these trends is essential to anticipate market movements and make smarter sourcing decisions.

Leverage real-time import-export intelligence with Export Genius to access accurate trade data, track market shifts, and stay ahead of the curve in the global energy sector.