As the global economy faces increasing volatility—from currency fluctuations and trade wars to energy shocks and geopolitical divides—the BRICS nations are making bold moves to reshape the rules of international commerce. At the July 2025 summit in Rio de Janeiro, leaders from Brazil, Russia, India, China, South Africa, and a growing circle of BRICS+ members unveiled a sweeping agenda focused on de-dollarisation, trade reform, infrastructure financing, and digital cooperation. Export Genius explained every aspect of the BRICS Summit 2025 and its potential trade impact.

Shift Toward Local-Currency Trade & Payments

Leaders agreed to accelerate trade settlements in national currencies via platforms like BRICS Pay / BRICS Bridge, reducing dependence on the US dollar. Russia reports that approximately 65–95% of internal BRICS trade already utilizes local currencies; the summit reaffirmed this trend.

Impact:

- Exporters/importers across BRICS avoid dollar volatility and SWIFT-related delays.

- Promotes financial stability, lowers costs, and incentivizes digital payment adoption.

WTO Reform & Promotion of Inclusive Trade

Trade ministers adopted a Joint Declaration backing WTO reform, aiming to restore its Appellate Body, curb unilateral tariffs, and bolster multilateral governance. India also pushed to eliminate export controls within BRICS to ease intra-bloc trade

Impact:

If implemented, we could see smoother supply chains, fewer trade disruptions, and a more supportive environment for South–South trade.

Strengthening the BRICS 2030 Economic Partnership

Extended until 2030, this strategy emphasizes trade facilitation, sustainable development, and digital economy integration. Included: digital regulation frameworks, enhanced data governance, and support for green/agri-tech sectors.

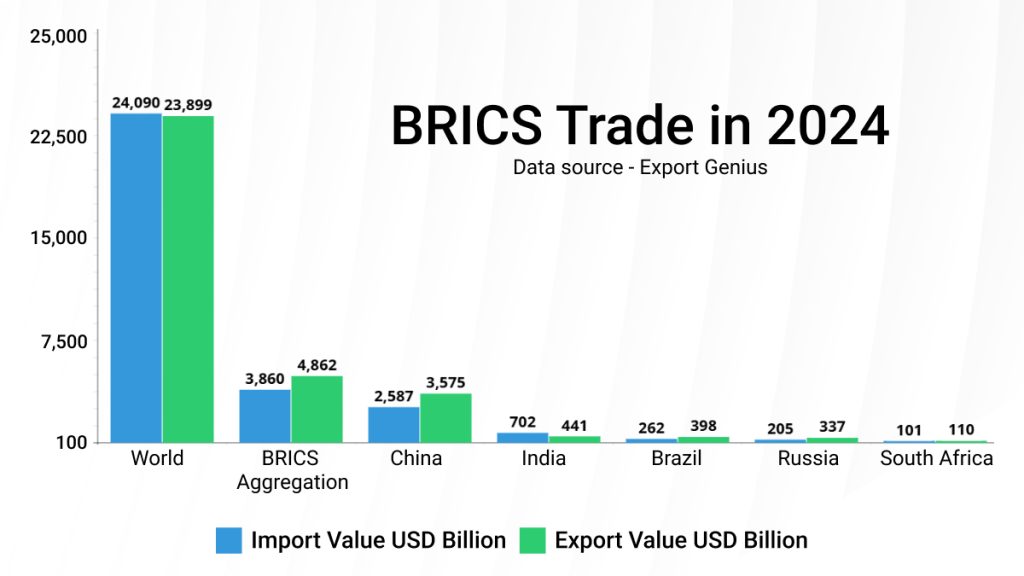

| Importers/Exporters | Import Value USD Billion | Export Value USD Billion |

| World | 24,090 | 23,899 |

| BRICS Aggregation | 3,860 | 4,862 |

| China | 2,587 | 3,575 |

| India | 702 | 441 |

| Brazil | 262 | 398 |

| Russia | 205 | 337 |

| South Africa | 101 | 110 |

Impact:

Tech, clean-tech, and agribusiness in BRICS nations gain traction through better cooperation and supportive policies.

New Financial & Guarantee Mechanism

Launched: BRICS Multilateral Guarantee (supported by the New Development Bank) to mobilize private investment in infrastructure and climate projects.

Impact:

Could lower financing costs for large projects across BRICS, boosting construction, energy, and green initiatives.

Geopolitical & Strategic Signaling

Strong statement against unilateral tariffs and trade restrictions, implicitly targeting rising protectionism. Emphasis on WTO reform and institutional multipolarity signals BRICS’s intent to act as a sovereign counterweight in global trade governance.

Impact:

Heightened policy divergence between BRICS and Western economies may lead to regional blocs and competing trade regimes.

Economic Context—Commodities & Energy

The summit took place amid an oil shock (Israel–Iran tensions) and ahead of OPEC+ meetings, impacting trade costs. BRICS members vary in energy interests—producers like Russia and Brazil vs. importers like India and China.

Impact:

Increased attention to energy-price volatility may influence tariff policies and drive investment in alternative energies across the bloc.

BRICS group condemns increase in tariffs in summit overshadowed by Middle East tensions

The BRICS bloc of developing nations on Sunday condemned the increase in tariffs and attacks on Iran, but refrained from naming U.S. President Donald Trump. He has threatened extra 10% tariffs on BRICS as leaders meet in Brazil. The group’s declaration, which also took aim at Israel’s military actions in the Middle East, also spared its member, Russia, from criticism and mentioned war-torn Ukraine just once.

Impact:

BRICS was founded by Brazil, Russia, India, China, and South Africa, but the group last year expanded to include Indonesia, Iran, Egypt, Ethiopia, and the United Arab Emirates. As well as new members, the bloc has 10 strategic partner countries, a category created at last year’s summit that includes Belarus, Cuba, and Vietnam.

That rapid expansion led Brazil to put housekeeping issues — officially termed institutional development — on the agenda to better integrate new members and boost internal cohesion.

The meeting was also an opportunity to advance climate negotiations and commitments on protecting the environment before November’s COP 30 climate talks in the Amazonian city of Belem.

The Bottom Line

The BRICS 2025 summit in Rio marked a pivotal moment in the evolving architecture of global trade. By advancing local currency transactions, calling for meaningful WTO reforms, and launching new financial tools to support infrastructure and sustainable development, the bloc sent a clear signal: emerging economies are no longer content to play by rules they didn’t write.

As BRICS deepens economic integration and strengthens South–South cooperation, its collective influence on trade flows, supply chains, and global governance will only grow. For businesses, investors, and policymakers alike, understanding the direction of BRICS isn’t optional—it’s essential.

Whether these ambitious goals translate into long-term structural change will depend on follow-through, global buy-in, and how competing powers respond. But one thing is clear: BRICS is no longer just a partnership of emerging markets—it’s a serious contender in shaping the future of global trade.