Global trade surged by $300 billion in the first half of 2025, marking a notable rebound amid persistent geopolitical and economic uncertainties. This growth, though modest in volume, was largely price-driven and spearheaded by a sharp increase in US imports—particularly ahead of new tariff regulations—and a steady rise in EU exports. While the data signals resilience in global commerce, it also reflects deepening trade imbalances and growing concerns about the long-term sustainability of this momentum.

With protectionist policies and supply chain shifts still shaping the global trade landscape, the first half of 2025 offers both encouraging signs and cautionary flags for the road ahead. Export Genius, a leading international trade platform, unfolds global trade resilience with US import data and EU export data.

A Solid First Half

According to UNCTAD, global trade grew by an estimated $300 billion in the first half of 2025, reflecting a 1.5% increase in Q1 and approximately 2% in Q2. This growth was largely driven by rising prices for goods—notably, prices nudged up while volumes only increased around 1%.

Why Growth Accelerated

Two standout regions powered this expansion:

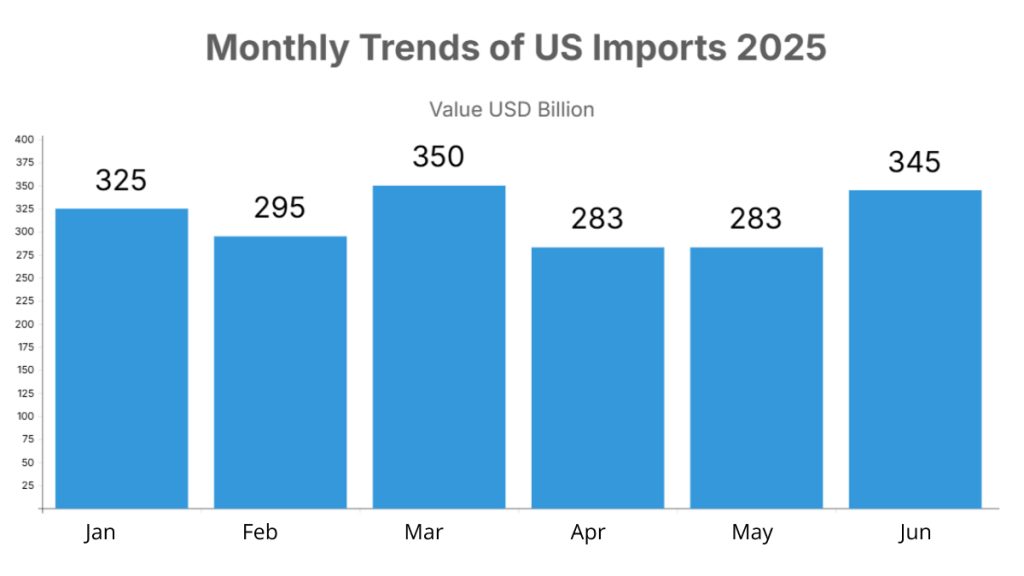

U.S. imports surged 14%, fueled by firms front-loading orders before the effective date of new U.S. tariffs (April 5 “Liberation Day” tariffs).

| Month | Value USD Billion |

| Jan | 325 |

| Feb | 295 |

| Mar | 350 |

| Apr | 283 |

| May | 283 |

| Jun | 345 |

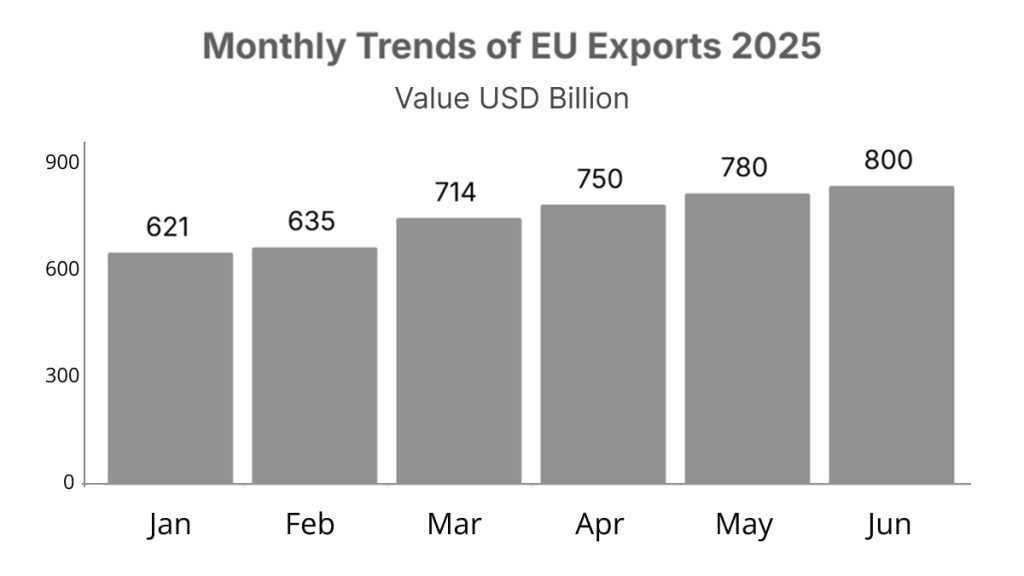

EU exports climbed 6%, helping developed economies regain trade momentum after lagging behind emerging markets.

| Month | Value USD Billion |

| Jan | 621 |

| Feb | 635 |

| Mar | 714 |

| Apr | 750 |

| May | 780 |

| Jun | 800 |

Conversely, developing nations saw a 2% drop in imports; South-South trade stagnated overall, though Africa’s exports rose by around 5% with intraregional trade up 16% year-on-year

Persistent Trade Imbalances

According to global trade data, highlights growing trade imbalances: the U.S. is widening its deficit, while China and the EU are running larger surpluses. The U.S. widened deficits with China ($360 billion), the EU ($276 billion), and Vietnam (~$116 billion).

The World Bank warns that continued U.S. trade tensions could slow growth in many developing economies and dampen trade expansion—global trade growth is now projected at just 1.8% in 2025.

Opportunities Amid Resilience

Despite persistent risks, some trends point to resilience:

- Services trade continues its strong run, up 9% year-on-year.

- Regional trade agreements and restructuring efforts (e.g., CPTPP–EU talks, AfCFTA implementation) may help offset fragmentation.

- Freight activity is rebounding from early-2025 lows, suggesting some recovery in volumes.

Bottom Line

First half of 2025: strong dollar gains ($300 billion, driven by U.S. import front-loading and EU export growth), but price-driven, not volume-driven.

Second half outlook: overshadowed by trade tensions, tariff risks, and slowing global demand—keeping growth fragile.

Key Watch Areas:

- Will the U.S. make tariffs permanent beyond the temporary block?

- Can new trade deals offer relief?

- Will services trade and regional pacts sustain momentum?

Continue following Export Genius for more informative content and insights into the international market.