Over the past decade, Asia has become the global backbone for technology manufacturing and supply chains. But recent tariff disputes—particularly between the U.S. and China—are reshaping the region’s landscape. As companies reevaluate risk, cost, and resilience, two countries are rapidly emerging as key alternatives: Vietnam and India. Export Genius reveals crucial statistics on the tech industries of Vietnam and India.

Why the Tariff Shock Matters

The ongoing U.S.-China trade tensions have introduced unpredictable tariffs on a wide array of electronics, semiconductors, and other tech components. These disruptions are no longer short-term headaches—they’re prompting permanent strategic pivots.

Tariffs have become not just trade policy tools, but catalysts for global supply chain realignment. For tech companies, this means finding new bases of operation outside of China’s traditionally dominant manufacturing ecosystem.

| Year | US Exports to China (Value USD Billion) | US Imports from China (Value USD Billion) |

| 2020 | 124 | 456 |

| 2021 | 151 | 540 |

| 2022 | 153 | 575 |

| 2023 | 147 | 448 |

| 2024 | 143 | 462 |

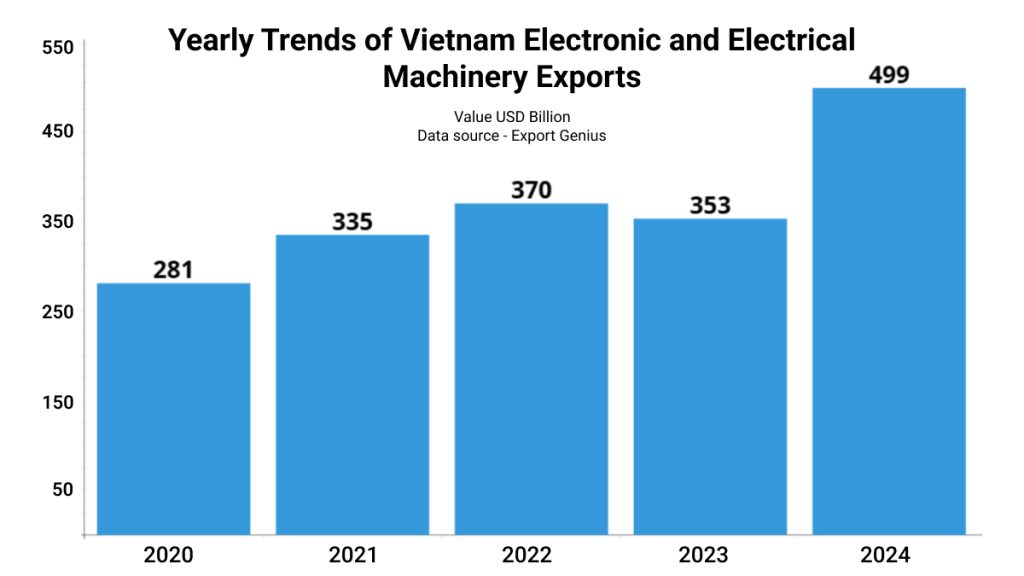

Vietnam: A Fast-Moving Tech Manufacturing Hub

Vietnam has rapidly established itself as a significant player in electronics assembly and component manufacturing. Major multinationals like Samsung, Apple suppliers (e.g., Foxconn, Pegatron), and Intel have ramped up investment in the country.

| Year | Value USD Billion |

| 2020 | 281 |

| 2021 | 335 |

| 2022 | 370 |

| 2023 | 353 |

| 2024 | 499 |

Why Vietnam is gaining traction:

- Proximity to China: Ideal for maintaining logistics while diversifying.

- FTA benefits: Access to trade agreements like the EU-Vietnam Free Trade Agreement (EVFTA) and CPTPP.

- Government incentives: Favorable tax and regulatory frameworks for high-tech investment.

Challenges remain, including labor skill development and infrastructure strain due to rapid growth. However, its agility and open-door policy for foreign investment make Vietnam a top alternative for low-to-mid complexity manufacturing.

India: The Long-Term Bet for High-Scale Diversification

India is also becoming increasingly attractive—especially for firms looking for a “China-plus-one” or even “China-plus-two” strategy. While its progress has been slower than Vietnam’s in certain segments, recent years have shown strong momentum.

Key tailwinds for India:

- PLI (Production Linked Incentive) schemes to boost electronics and semiconductor production.

- Growing domestic market for tech hardware and software.

- Support from companies like Apple, Micron, and Tesla, who are expanding operations in India.

India’s appeal lies not just in low costs, but in scale and long-term potential. It also plays a growing geopolitical role as a strategic partner for Western economies seeking to de-risk their China exposure.

What This Means for Global Tech Strategy

The rise of Vietnam and India as alternative tech manufacturing centers is not just a reaction to tariffs—it’s part of a broader realignment. Companies are no longer thinking in terms of “lowest cost,” but rather in terms of supply chain resilience, market access, and political stability.

China will remain an integral part of global tech, but its dominance is being diluted as firms diversify. The tariff disruptions have merely accelerated a trend that was already in motion due to labor costs, geopolitical tensions, and the COVID-era supply chain shocks.

The Last Words

As Asia’s tech supply chain transforms under tariff pressure, Vietnam and India are not just filling gaps—they’re shaping the future. For businesses, investors, and policymakers, keeping a close eye on these two emerging powerhouses is no longer optional—it’s essential.