Introduction

As Donald Trump won the U.S. elections, the European Union (EU) may discuss common economic security measures against China with America’s new administration after the results. This step would preserve or enhance the trans-Atlantic relationship. However, to get there, it will have to overcome the current resistance from Germany and other EU member states to use coercive economic instruments.

The EU is sure to face American expectations that it will implement economic sanctions against China, including curbing China’s aggressive economic practices and safeguarding critical technologies, tariffs, investment controls, and new export controls.

A Glimpse of Harris vs. Trump administration before elections

Under a Harris administration, it seems more likely that the United States of America and the European Union could build on their previously close cooperation on sanctions against Russia to coordinate on China policy. But working with allies could also be part of Donald Trump’s China policy. There are two main reasons for this:

- Most Republican strategists, even in the MAGA camp, agree that sanctions are more effective when implemented by a border coalition.

- U.S. business interests are likely to push any administration to ensure that the coasts of sanctions are shared.

To find common agreement with Washington, EU member states must decide whether they are willing to use coercive tools against China. Some countries, most notably Germany remain reluctant to do so.

How the EU could get ahead in trans-Atlantic talks?

The United States is expected to implement additional export controls on quantum computers, semiconductors, and additive manufacturing. The country could also implement outbound investment controls to limit capital and knowledge transfer to China in certain semiconductor and microelectronics, quantum, and AI systems as soon as this fall.

As the U.S. gets a new President, it would be a smart time for the EU to get ahead in trans-Atlantic bargaining. EU could seek internal consensus on a clear definition of economic security, which remains vaguely defined in their strategy. To do so, the EU could draw on its Common Foreign and Security Policy, which includes financial sanctions as an instrument. This allows the use of restrictive measures for a wide range of foreign and security policy objectives and can be targeted at specific governments.

What is likely for U.S.-EU talks on economic security?

The next U.S. president is likely to be more robust EU action on China. There are four major policy areas where the United States is pressing the EU to do more:

Restrict the Chinese Companies into Competitive Industries in Europe

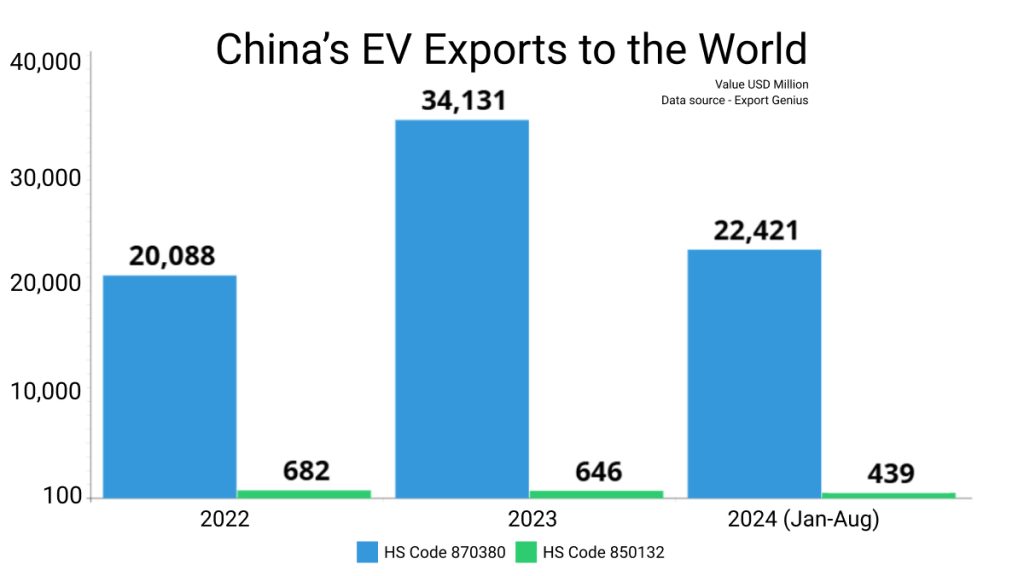

The United States wants EU to use the newly developed anti-subsidy trade instrument to counter the aggressive entry of Chinese companies into competitive sectors in Europe. The European Union did for the first time with tariffs on Chinese electric vehicle (EV) imports.

China is the world’s largest producer and exporter of electric vehicles. The country has aggressively pushed for electric mobility both domestically and internationally, through significant government support, infrastructure, and leading EV manufacturers.

| Year | HS Code 870380 | HS Code 850132 |

| 2022 | 20,088 | 682 |

| 2023 | 34,131 | 646 |

| 2024 (Jan-Aug) | 22,421 | 439 |

*****Value USD Million

*****Electric Vehicle is majorly categorized into the following Harmonized System Codes:

- 870380: Electric motor vehicles (passenger vehicles)

- 850132: Electric motors used in EVs (battery-powered motors)

- Export Control Measures

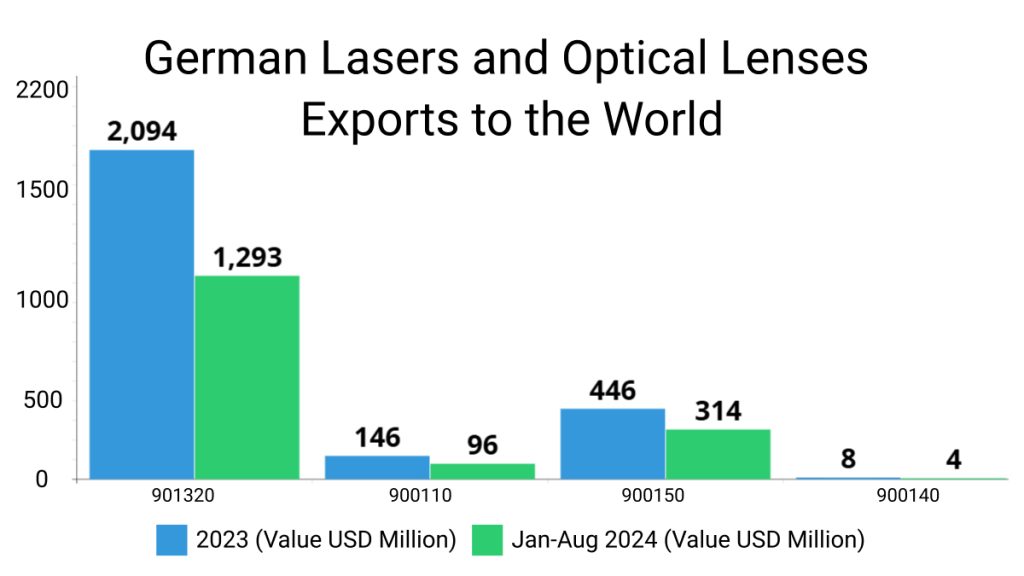

Based on the U.S. export control schedule, the EU could use its own choke points, allowing Europeans to threaten to exclude China from technologies exported by companies in certain member states, for instance, lasers and optical lenses exported by German companies.

| HS Code | 2023 (Value USD Million) | Jan-Aug 2024 (Value USD Million) |

| 901320 | 2,094 | 1,293 |

| 900110 | 146 | 96 |

| 900150 | 446 | 314 |

| 900140 | 8 | 4 |

******* Lasers and optical lenses are categorized in the following Harmonized System Codes:

- 901320: Lasers (solid-state lasers, gas lasers, fibre lasers)

- 900110: General optical lenses

- 900150: Lenses for cameras, microscopes, and other optical instruments

- 900140: Lenses for eyeglasses and optical glasses

- Moving Beyond Investments

The U.S. could move from screening investments toward the potential mandatory registration of certain sectoral investments from the EU into China. This would help the EU understand where its potential future outbound investment controls might substantially affect China, and improve the EU’s data on such flows.

- Working on EU Sanctions

The United States would work on the development of the EU sanctions roadmap, including significant escalatory steps – should China move toward a military invasion of Taiwan in three to five years. This could also include wide-ranging import bans on consumer goods entering the EU single market from an important trade partner like China yet unchartered terrain for the EU.

What is keeping the European Commission from going ahead?

While the European Commission has expressed a willingness to take a tougher stance on China, EU member states have wavered. The arguments against using a wider range of coercive economic instruments against China traditionally fall into three categories.

First, politicians argue that the European Union is not equipped to pursue a policy of economic sanctions in the same way as the United States. Second, politicians claim that the United States sanctions policy is based on different ethical norms. Their argument is that the U.S. government often makes unilateral sanctions decisions without seeking multilateral support, such as from the United Nations.

Third, some Europeans claim to have a different understanding of the boundaries between security and economic policy. This level of argument contrasts with EU member states’ willingness to brush aside doubts about using sanctions and other coercive economic instruments after Russia invaded Ukraine.

“German problem”

Germany’s decision to vote against permanent EU tariffs on Chinese EV imports mainly stems from its unwillingness to confront China’s potential retaliation. This opposition may extend beyond EV tariffs and impact the broader economic security strategy that Washington seeks to establish with the EU regarding China. According to a report, a full decoupling from China could incur severe costs for the German economy. Yet, losses could mirror those experienced during global financial crisis and the Covid-19 pandemic.

The largest German car and chemical companies’ production in Germany may be less affected by Chinese retaliation. However, Germany’s small and medium-sized enterprises (SMEs), which face increasing pressure from Chinese competitors would benefit from a tougher EU approach. These companies are already under pressure and losing market share, which could lead to future layoffs, a weakening of Germany’s traditionally strong manufacturing sector, and a decline in innovation.

Solution

This is not the first time; that German companies’ investment ties have led Berlin to resist the European Commission’s efforts to change its relationship with a significant external factor. To change this dynamic and win the German government’s support for a common economic strategy, two things are needed.

First, the German government must honestly debate and recalibrate its China-related economic policies in consideration of SME’s concerns, and competitive pressures. Second, The European Commission must develop a strategy on how to meaningfully compensate for losses related to economic battles with China. This would help political leaders in Germany and other member states that are increasingly targeted by Chinese retaliation.

The Final Words

In conclusion, the EU’s potential adoption of economic sanctions against China hinges on overcoming significant internal resistance, particularly from Germany, which fears retaliation and economic fallout. Although the European Commission aims to enhance trans-Atlantic cooperation on economic security, a unified approach requires member states to reconcile their differing views on coercive measures.

For all the latest updates on how the new U.S. government would create a security and economic policy with the EU against China; keep following Export Genius. Also, access the latest global trade data with actual shipment records.