President Donald Trump has raised steel and aluminium tariffs to 50% from 25%, following through on a pledge to boost US import taxes to help domestic manufacturers. However, metal charges on imports from the United Kingdom will remain at the previous 25% rate, allowing the two nations to work on new levies or quotas.

Trump’s latest levy is fanning trade tensions at a time when the United States is locked in negotiations with numerous trading partners over his so-called “reciprocal” duties ahead of a July 9 deadline. Steel and aluminum are utilized in almost everything, from appliances used in vehicles and construction materials to canned goods. What will be the possible impact of this tariff hike on global exports of steel and aluminium? Find relevant and stats-based analysis here.

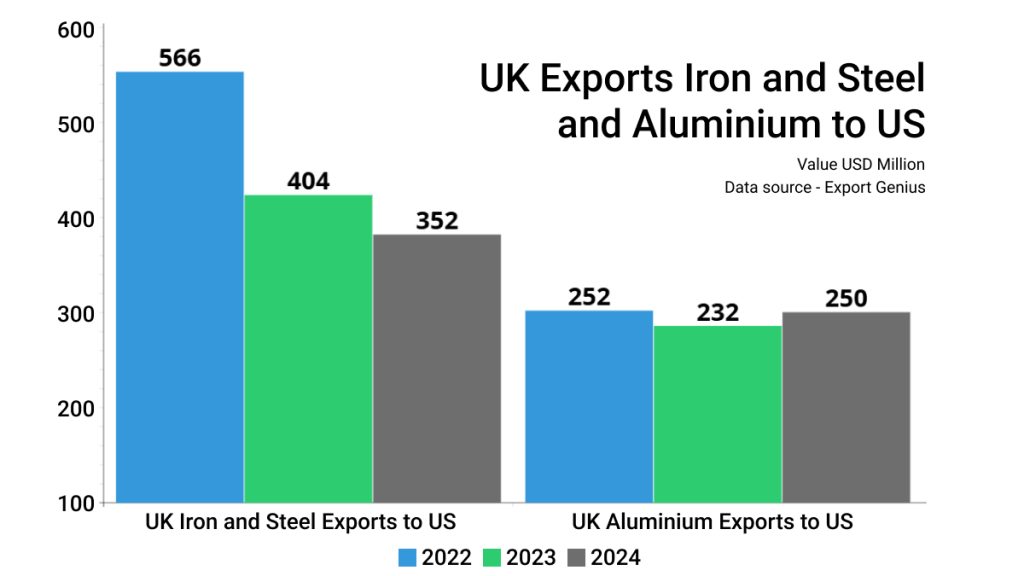

UK is relieved of the 50% metal tariff

The metals charges on imports from the United Kingdom will remain at the previous 25% rate to allow the two nations to work on new levies or quotas at least till the July 9 deadline.

| Year | UK Iron and Steel Exports to US | UK Aluminium Exports to US |

| 2022 | 566 | 252 |

| 2023 | 404 | 232 |

| 2024 | 352 | 250 |

*****Value USD Million

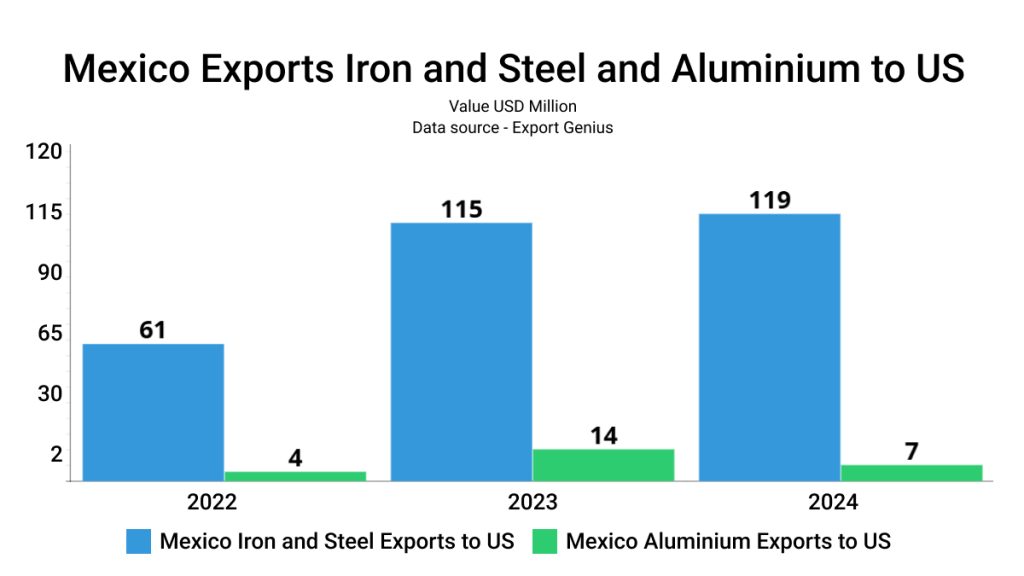

Mexico is a significant supplier of steel and aluminium to the U.S.

Mexico has said it will ask the US administration for its own exemption. The tariff increase puts over $20 billion in annual exports at risk, affecting key sectors like construction, electronics, and automotive.

| Year | Mexico Iron and Steel Exports to US | Mexico Aluminium Exports to US |

| 2022 | 61 | 4 |

| 2023 | 115 | 14 |

| 2024 | 119 | 7 |

*****Value USD Million

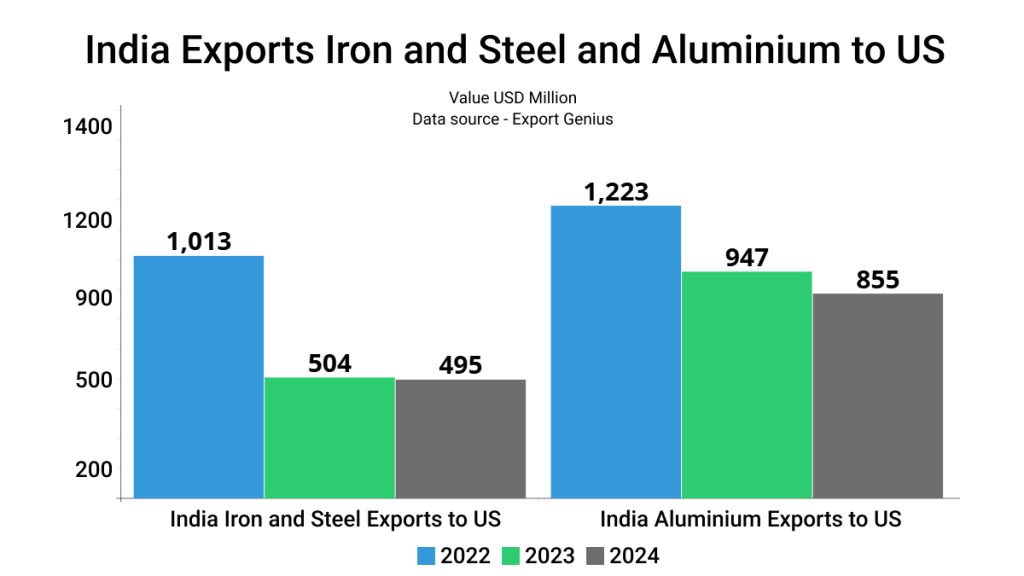

Impact on India’s steel and aluminium exports

India is also one of the major suppliers of iron and steel and aluminium to the United States. India’s exports of iron and steel and aluminium are also expected to decline due the tariff hike. However, India has started talks with U.S. trade officials to avoid being unfairly penalized. India may also explore seeking exemptions or bilateral agreements to protect certain high-value metal exports.

| Year | India Iron and Steel Exports to US | India Aluminium Exports to US |

| 2022 | 1,013 | 1,223 |

| 2023 | 504 | 947 |

| 2024 | 495 | 855 |

*****Value USD Million

Economists have warned of price surge on essential goods from groceries to construction materials. Meanwhile, steel prices in the United States have already climbed 16% since January.

The Bottom Line

Former President Donald Trump’s decision to double U.S. tariffs on steel and aluminum to 50% marks a significant escalation in protectionist trade policy. While intended to strengthen domestic manufacturing and reduce reliance on foreign metals, the move has triggered widespread concern across global markets.

Key takeaways

- Major exporters like Canada, Mexico, India, and the EU face substantial economic risk, prompting retaliation or calls for exemptions.

- Emerging economies such as India may not be directly targeted but could feel the impact through supply chain shifts, increased global competition, and market volatility.

- The policy risks reigniting trade tensions, potentially leading to tit-for-tat tariffs and broader disruptions in international trade.

As countries evaluate their responses, the long-term success of this tariff strategy will depend on whether it can genuinely revive U.S. industry without alienating key trading partners or destabilizing global commerce.