United States (US) President Donald Trump’s 100% tariffs on branded and patented pharmaceutical products would put a burden on global exporters, particularly companies in India. The tariffs came into effect from 1st October 2025, which would make a sharp departure from an international trading system designed to support global health and equitable access to medicines. This would probably have far-reaching consequences for global health security, pharmaceutical supply chains, and major drug exporters such as India. Export Genius outlines the impact of US tariffs on the global pharmaceutical industry, using key global trade data.

The Tariff Announcement

The announcement was not unexpected, as Trump, in an interview in August this year, outlined plans to introduce pharma-specific tariffs incrementally, reaching up to 250 per cent over 18 months. These efforts are part of the administration’s goal to bring drug production to American shores and address its trade deficit, as pharmaceuticals accounted for $ 139 billion of the US’s $1.2 trillion total goods trade deficit in 2024. A 25 per cent tariff on pharmaceuticals is projected to raise annual US drug costs by around US$51 billion, driving prices up by as much as 13 per cent.

The newly announced tariffs would affect exports of branded and patented drugs to the US by companies that have yet to establish local manufacturing. This is significant, as a considerable proportion of US drug spending is attributed towards patent-protected medicines. While generics make up nearly 90 per cent of all prescriptions, they represent just one-eighth of overall expenditure, highlighting the outsized role of branded drugs in driving up costs.

Global Pharmaceutical Trade

The US imported approximately US$200 billion worth of pharmaceutical products in 2024, with Ireland, Germany, and Switzerland among the leading exporters. In its recent trade deal with the European Union (EU), Washington imposed 15 per cent tariffs on pharmaceutical products.

Further, in March 2025, the US, under its Trade Expansion Act, 1962, initiated a Section 232 review of its pharmaceutical imports for national security risks. The findings are scheduled to be released in March 2026, so it remains unclear whether the newly announced 100 per cent tariffs are linked to this investigation and if additional duties may follow later. The EU is shielded from the newly announced 100 per cent tariffs as well as any additional tariffs that may follow the Section 232 review, while Japan may face duties depending on the outcome of the review. The United Kingdom (UK), meanwhile, is continuing its negotiations with Washington to secure tariff exemptions for its pharmaceutical sector.

Trade Challenges

The US intends to reduce drug costs and bring production to American shores, but tariffs may not be the most effective method to achieve this goal. The current strategy rests on the assumption that it will raise the cost of imported drugs, shift consumer demands towards domestic alternatives, and stimulate US drug manufacturing and job creation.

This does not take into account the complexities of expanding domestic pharmaceutical manufacturing. Estimates suggest that meaningful scale-up could take anywhere between five to ten years. Tariffs will likely encourage manufacturers of high-margin branded and patented drugs to establish manufacturing facilities in the US, either by building new plants or by acquiring existing ones.

However, such efforts are also likely to be marred by several challenges, including significant capital and time investment, higher construction costs due to steel and aluminium tariffs (resulting from a Section 232 review), stringent regulatory hurdles, and the need for a highly-skilled workforce.

Implications for India

India’s pharmaceutical sector faces significant challenges following the recent US trade measures. While generics remain exempt from the 100 per cent tariffs, any future expansion of the tariff regime to generics and biosimilars would disproportionately impact India, which supplies almost 40 per cent of US generics. In addition, medical devices are now included in the Section 232 ambit; India’s medical device exports, valued at nearly US$300 million in FY 2024, already face 50 per cent tariffs and could potentially face additional duties.

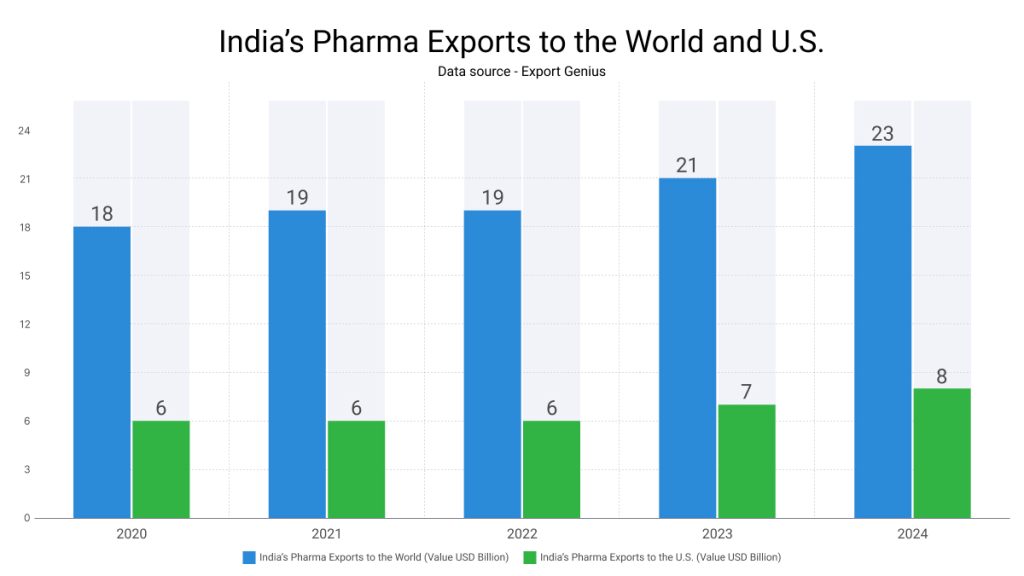

| Year | India’s Pharma Exports to the World (Value USD Billion) | India’s Pharma Exports to the U.S. (Value USD Billion) |

| 2020 | 18 | 6 |

| 2021 | 19 | 6 |

| 2022 | 19 | 6 |

| 2023 | 21 | 7 |

| 2024 | 23 | 8 |

Accordingly, tariff tensions have reignited India’s trade diplomacy agenda. At the recent meeting of BRICS Foreign Ministers on the sidelines of the UNGA, leaders—including India—called for urgent reforms in multilateral trade bodies, highlighting how tariff-driven disruptions threaten equitable access to medicines and create systemic pressures for emerging economies. Ensuring the continued production of generics and biosimilars for both the US and emerging economies in Africa, Asia, and Latin America will be critical to safeguarding global health, sustaining innovation, and reinforcing India’s position as a reliable partner in international pharmaceutical trade.

Conclusion

The imposition of US pharmaceutical tariffs has created ripple effects far beyond trade deficits and domestic politics. These policies are disrupting global supply chains, inflating drug prices, stifling innovation, and restricting access to essential medicines—particularly in developing countries. As the global health landscape grows increasingly interconnected, unilateral trade barriers threaten not only economic balance but also the collective fight against disease and health inequality.

In this complex and evolving environment, access to accurate, real-time trade data is more critical than ever. Businesses, policymakers, and health organisations need actionable insights to navigate changing regulations, assess market risks, and identify opportunities amidst disruption.

Whether you’re a pharmaceutical exporter, importer, researcher, or policy analyst, Export Genius provides comprehensive global trade data to help you stay ahead. Monitor tariff impacts, track supply chain shifts, and make informed decisions with confidence.