As the Trump administration reintroduces aggressive tariff measures in 2025, the U.S. economy is entering a new phase of uncertainty. The US is imposing higher tariffs on countries, including a 50% tariff on Indian goods, in a 25% penalty on importing Russian oil. How would this scenario impact the US economy? Export Genius shares key stats and possible impact on America’s imports and bilateral trade with India.

At a time when inflation remains a concern and global supply chains are still recovering from years of disruption, new tariffs threaten to push prices higher, strain key industries, and provoke retaliation from America’s trading partners. Economists warn that the broader economic impact could include slower growth, higher consumer costs, and job losses in sectors heavily dependent on trade.

In this article, we explore the current and potential consequences of U.S. tariffs on the American economy—who stands to benefit, who could lose, and what it all means for consumers, businesses, and the future of U.S. trade policy.

Trump’s tariffs—particularly those imposed during his presidency on goods from countries like China, Canada, and the European Union—were intended to protect American industries and reduce the trade deficit. However, these tariffs have had mixed economic effects, and in many ways, they have hurt the U.S. economy. Here’s an explanation of how and why:

Tariffs Are Essentially a Tax on Imports

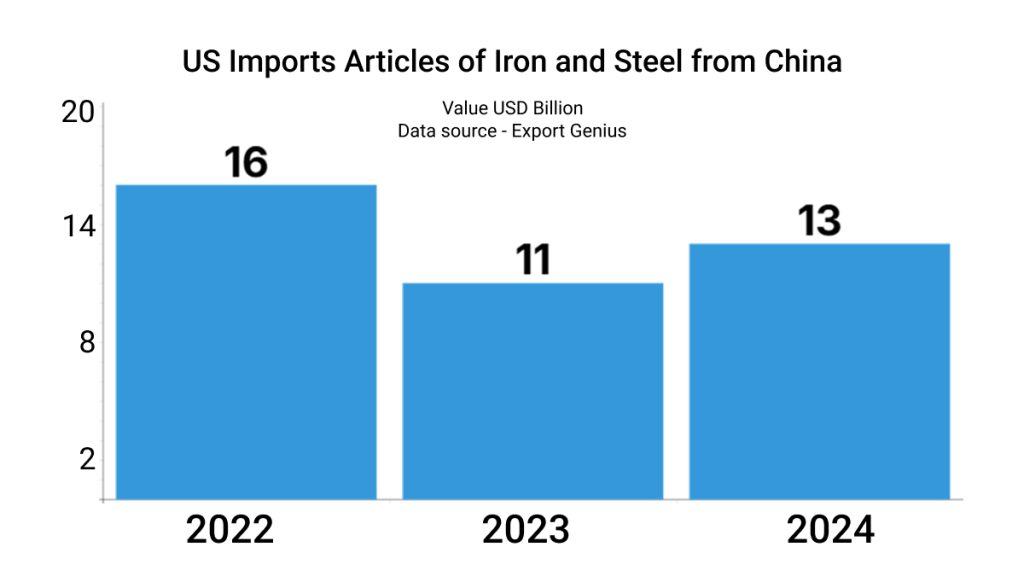

Tariffs raise the cost of imported goods. For example, a 25% tariff on articles of iron and steel from China means American companies must pay 25% more for that imported steel.

| Year | Value USD Billion |

| 2022 | 16 |

| 2023 | 11 |

| 2024 | 13 |

Who pays?

U.S. companies and consumers, not foreign exporters, typically bear the cost of tariffs. Importers pass on the extra costs to American buyers—businesses and households.

Higher Prices for Consumers

Tariffs increase costs for businesses that rely on imported goods or components (e.g., steel, electronics, auto parts). Those higher costs often get passed on to consumers in the form of:

- Higher prices for goods and services

- Fewer product choices

- Lower purchasing power

This can feel like inflation—even when general inflation is otherwise under control.

Disruption of Supply Chains

Many U.S. manufacturers depend on global supply chains. Tariffs can:

- Force companies to shift suppliers, sometimes at higher cost

- Lead to production delays

- Increase uncertainty and complexity in operations

Some companies move production offshore to avoid tariffs, counterintuitively reducing domestic manufacturing jobs.

Retaliation by Other Countries

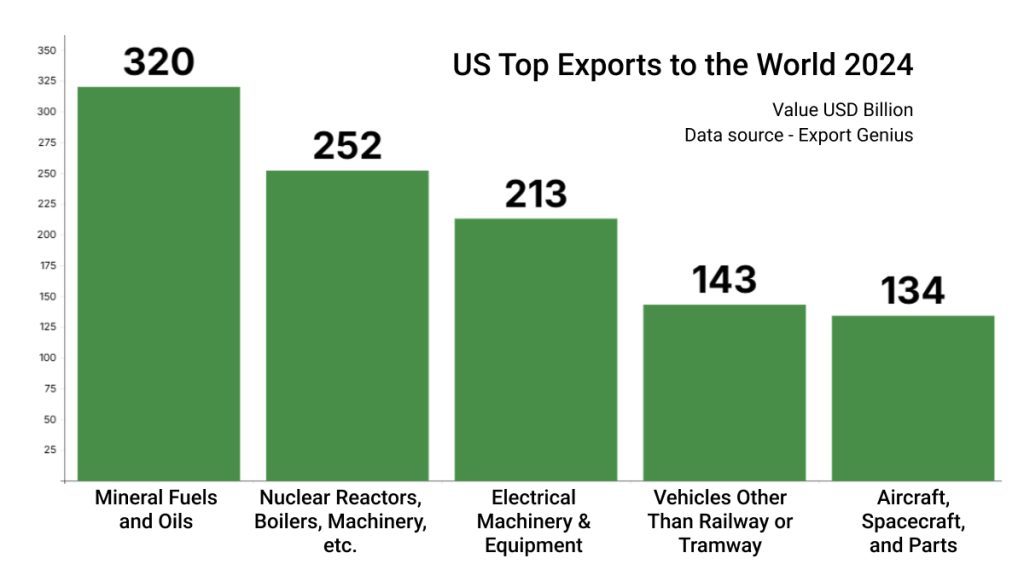

When the U.S. imposes tariffs, other countries often retaliate with tariffs of their own—particularly against American exports like:

- Agricultural products (soybeans, pork, dairy)

- Automobiles

- Machinery

| Commodity | Value USD Billion |

| Mineral Fuels and Oils | 320 |

| Nuclear Reactors, Boilers, Machinery, etc. | 252 |

| Electrical Machinery & Equipment | 213 |

| Vehicles Other Than Railway or Tramway | 143 |

| Aircraft, Spacecraft, and Parts | 134 |

This hurts U.S. farmers and exporters, especially in rural areas. The Trump administration even created a multi-billion-dollar bailout program for farmers harmed by retaliatory tariffs.

No Significant Return in Jobs

One of the primary goals of tariffs was to protect and revive U.S. manufacturing jobs. While some steel and aluminum producers may have benefited short term:

- The broader manufacturing sector lost more jobs than it gained, partly due to higher input costs

- Studies found that for every job saved in protected industries, several were lost in others

Trade Deficit Not Significantly Reduced

Despite the goal of narrowing the trade deficit (importing less than exporting), the U.S. trade deficit remained large during and after the tariffs.

- Americans continued to buy foreign goods, just at higher prices

- Tariffs shifted trade patterns but didn’t eliminate the imbalance

Financial Market Uncertainty

Tariff announcements often caused market volatility and business investment pullbacks. Uncertainty about future trade policies made companies more cautious with hiring and expansion.

Bottom Line

Trump’s tariffs were intended to shield American industries, reduce the trade deficit, and bring manufacturing jobs back to the U.S. But the policies delivered mixed—and in many cases, negative—economic consequences. While some sectors benefited in the short term, the broader economy faced higher consumer prices, disrupted supply chains, retaliatory trade actions, and slower growth.

As the U.S. continues to navigate complex global trade dynamics under the renewed Trump administration, understanding the real-world effects of tariffs is more important than ever—for businesses, policymakers, and investors alike.

Stay Ahead with Export Genius

Whether you’re tracking the impact of tariffs or planning your next move in global trade, Export Genius offers the data-driven insights you need. Our international trade intelligence platform gives you access to real-time import-export data, market trends, and competitor analysis—so you can make smarter, faster decisions in a volatile trade environment.

Explore our trade data solutions today at Export Genius and gain the competitive edge in global commerce.