The 2025 G7 Summit, held in the secluded mountains of Kananaskis, Alberta, was meant to be a forum for unity. Instead, it revealed just how fractured—and dynamic—the world’s leading economies have become. From newly inked bilateral trade agreements to unresolved tariff disputes and shifting global power plays, this year’s summit offered a striking snapshot of the evolving nature of international cooperation. Export Genius tries to bring a bigger picture with essential stats of what G7 2025 tells us about global alliances.

UK–US Trade Agreement

A notable outcome was the signing of a UK–US trade deal between President Donald Trump and Prime Minister Keir Starmer. This agreement includes substantial reductions in tariffs on British goods and expanded quotas for UK exports of certain American agricultural products. The deal aims to strengthen economic ties between the two nations post-Brexit.

The United Kingdom exports a range of agricultural products to the United States, with key categories including:

Dairy Products

- Cheese: Approximately £68 million in exports to the U.S.

- Butter: Around £3.5 million in exports to the U.S.

Meat Products

- Beef: Approximately £2.9 million in exports to the U.S.

- Pork: About £23 million in exports to the U.S.

Seafood

- Fish and Crustaceans: Roughly £310 million in exports to the U.S., with salmon being a significant contributor.

Food Preparations

- Miscellaneous Food Preparations: Including sauces, with exports valued at approximately £113 million.

These figures reflect the UK’s agricultural export landscape to the U.S., highlighting key sectors and their economic contributions.

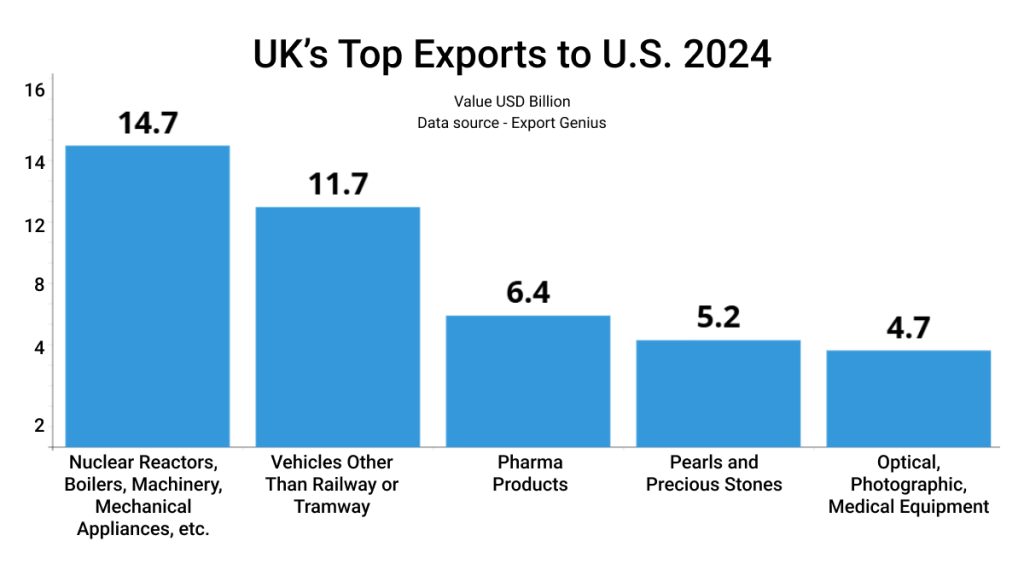

UK’s total exports to the United States reached USD 71.3 billion in 2024, a rise from USD 71.1 billion in 2023.

| Product | Value USD Billion |

| Nuclear Reactors, Boilers, Machinery, Mechanical Appliances, etc. | 14.7 |

| Vehicles Other Than Railway or Tramway | 11.7 |

| Pharma Products | 6.4 |

| Pearls and Precious Stones | 5.2 |

| Optical, Photographic, Medical Equipment | 4.7 |

India’s Engagement at the Summit

Indian Commerce Minister actively participated in the summit, engaging in bilateral discussions with several G7 counterparts:

United Kingdom: India and UK focused on advancing the India–UK Free Trade Agreement (FTA). The agreement is nearing completion and is expected to be signed as early as October.

| Year | India’s Exports to UK | India’s Imports from UK |

| 2022 | 11 | 9 |

| 2023 | 12 | 7 |

| 2024 | 14 | 8 |

*****Value USD Billion

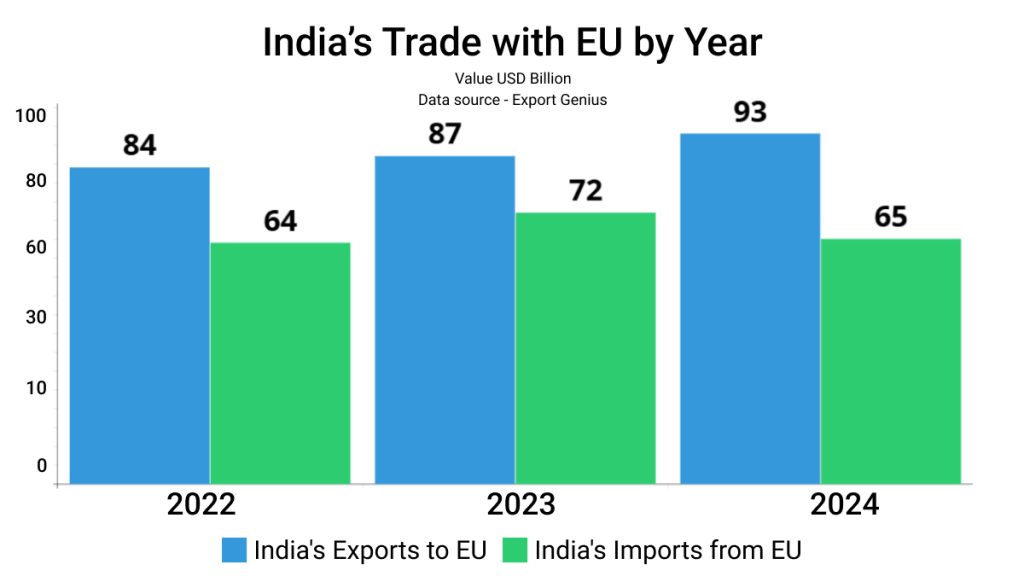

European Union: Discussions with EU centered on promoting India–EU trade and economic collaborations, including ongoing FTA negotiations.

| Year | India’s Exports to EU | India’s Imports from EU |

| 2022 | 84 | 64 |

| 2023 | 87 | 72 |

| 2024 | 93 | 65 |

*****Value USD Billion

Germany: The leaders of India and Germany held a bilateral meeting, strengthening Indo-German economic ties, focusing on industrial co-production and clean technologies.

| Year | India’s Exports to Germany | India’s Imports from Germany |

| 2022 | 10 | 13 |

| 2023 | 9 | 17 |

| 2024 | 10 | 17 |

*****Value USD Billion

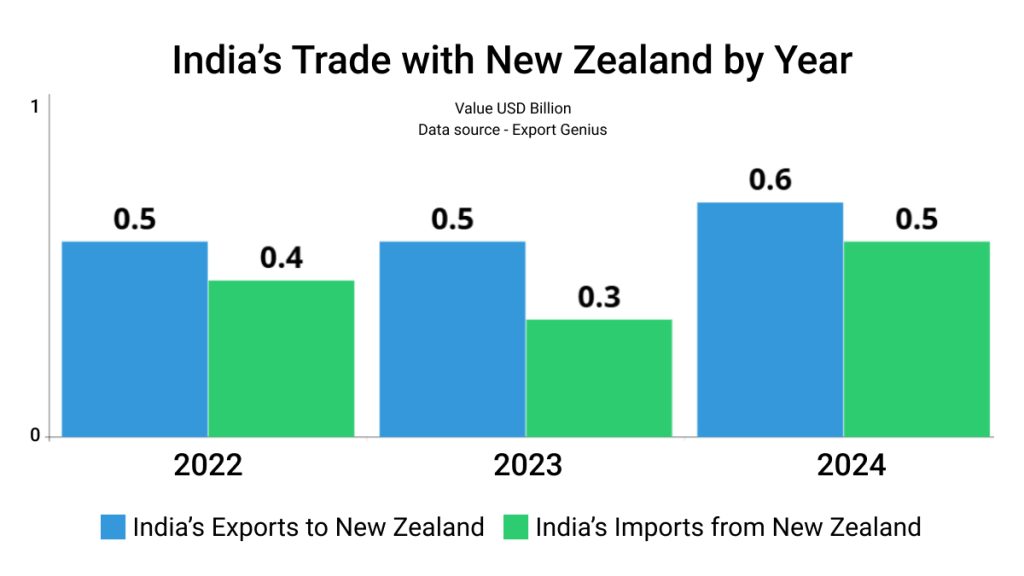

New Zealand: Conversations between India and New Zealand trade ministers explored opportunities to enhance bilateral trade and investment ties for mutual growth.

| Year | India’s Exports to New Zealand | India’s Imports from New Zealand |

| 2022 | 0.5 | 0.4 |

| 2023 | 0.5 | 0.3 |

| 2024 | 0.6 | 0.5 |

*****Value USD Billion

India’s trade minister also highlighted the country’s initiatives to reinforce global supply chains, particularly in critical areas such as minerals, semiconductors, pharmaceuticals, and green energy. He advocated for public-private partnerships, investments in critical infrastructure, innovation, and consistent regulatory frameworks across G7 countries and partner nations.

Japan–US Trade Negotiations

Japanese Prime Minister reported ongoing disagreements with the United States regarding tariff negotiations, particularly concerning the 25% tariff imposed by the U.S. on Japanese auto imports. Despite discussions, no comprehensive agreement was reached during the summit.

Canada’s Role and Broader Trade Dynamics

Canadian Prime Minister Mark Carney, as the host of the summit, proposed a 30-day deadline for negotiating a deal that would exchange increased Canadian defense spending for tariff relief on steel, aluminum, and auto imports. However, President Trump showed little willingness to compromise, and discussions with leaders from Mexico, India, and South Korea were postponed as he departed early due to escalating conflicts in the Middle East.

The summit underscored the complex landscape of global trade relations, with nations navigating protectionist policies, ongoing negotiations, and the need for resilient supply chains amid geopolitical tensions.

The Bottom Line

The 2025 G7 Summit didn’t deliver sweeping unity. Instead, it showcased a world where every handshake is strategic and every tariff a negotiation chip. While some agreements moved forward, others stalled, reflecting a broader shift in how global economic leadership is exercised. For business leaders, investors, and policymakers, the message is clear: expect less consensus and more competition—even among allies.