In a bold escalation of trade tensions, the United States has imposed a 25% tariff on a range of Indian exports, triggering concern across global markets. The move, seen by some as part of a broader protectionist agenda, could have far-reaching implications for bilateral trade between the two democracies and ripple effects across supply chains worldwide.

Which Indian sectors will be hit hard? What are bilateral trade relations between India and the United States? How US-Pakistan trade deal matter to India? Export Genius answers every question related to the potential impact of US tariffs on India with global trade data and in-depth insights.

Why Trump matters to India

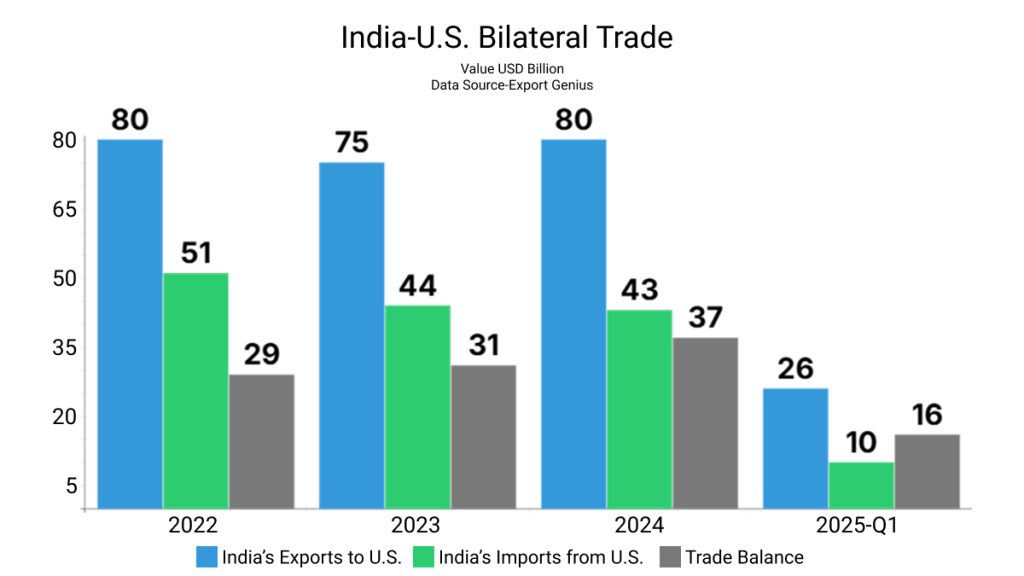

The U.S. is India’s largest trade partner, and India had a trade surplus of USD 37 billion in 2024. According to India U.S. bilateral trade data, India’s exports to the U.S. totalled USD 80 billion and India’s imports from the U.S. totalled USD 43 billion last year.

| Year | India’s Exports to U.S. | India’s Imports from U.S. | Trade Balance |

| 2022 | 80 | 51 | 29 |

| 2023 | 75 | 44 | 31 |

| 2024 | 80 | 43 | 37 |

| 2025-Q1 | 26 | 10 | 16 |

******Value USD Billion

Major products traded between India and the United States

In 2024, India’s main exports to the US included drug formulations and biologicals, telecom instruments, precious and semi-precious stones, petroleum products, vehicle and auto components, gold and other precious metal jewellery, ready-made garments of cotton, including accessories, and products of iron and steel.

Imports included crude oil, petroleum products, coal, coke, cut and polished diamonds, electric machinery, aircraft, spacecraft and parts, and gold.

| India’s Exports to U.S. | Value USD Billion | India’s Imports from U.S. | Value USD Billion |

| Smartphones | 7 | Crude Oil | 4 |

| Diamonds | 4 | LNG | 2 |

| Medicaments | 3 | Diamonds | 2 |

| Light Oils & Preparations | 3 | Coal | 2 |

| Frozen Shrimps | 1 | Gold | 1 |

US President Donald Trump’s 25% tariff on Indian exports from August 1 is expected to hurt a spate of sectors from makers of apparel and generic drugs to jewellery and auto component firms.

Gems and Jewellery

High tariffs could disrupt critical supply chains in the gems sector and threaten thousands of livelihoods.

According to US import data, the US accounts for over USD 10 billion worth of India’s exports from this industry. It would inflate costs, delay shipments, distort pricing, and place immense pressure on every part of the value chain from workers to large manufacturers, India’s Gem and Jewellery Export Promotion Council said.

Pharmaceuticals

At an approximate annual value of USD 8 billion, India is the largest exporter of non-patented drugs to the US. During the COVID-19 pandemic, India supplied medicines and pharma essentials to the United States worth USD 6 billion.

Textiles, Apparels

Home fabrics, apparel, and shoe makers in India serve the global supply chains of large US retailers, including large companies like The Gap Inc., Pepe Jeans, Walmart Inc., and Costco Wholesale Corp.

New tariffs present a “stiff challenge” for the sector, according to a statement from the Confederation of Indian Textile Industry. “It will seriously test the resolve and resilience of India’s textile and apparel exporters as we will not enjoy a significant duty differential advantage.”

Electronics

India overtook China to become the top source of smartphones sold in the US, after Apple Inc. shifted to assemble more of its iPhones in the South Asian country. This could be at risk after the latest levy.

According to a report, a 25 per cent surcharge on imports would most likely force Apple to revise this plan.

Indian Refiners

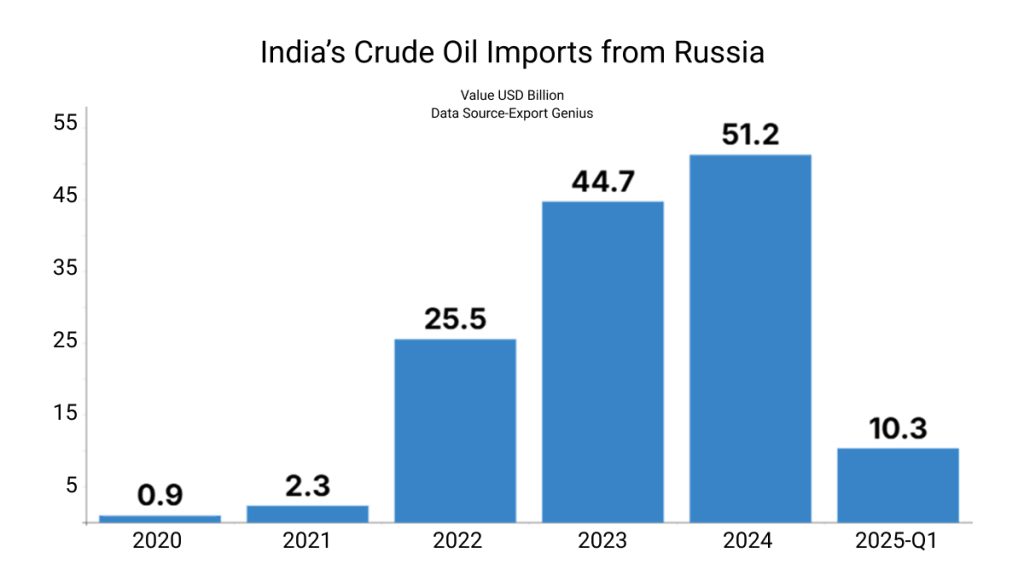

India gets nearly 37 per cent of its oil imports from Russia. These barrels come at a discount price and have been a key support for gross refining margins. If Russian crude is no longer available, the cost of imports will spike and dent refiners’ profits. According to global trade data, India imported crude oil worth USD 143 billion in 2024.

| Year | Value USD Billion |

| 2020 | 0.9 |

| 2021 | 2.3 |

| 2022 | 25.5 |

| 2023 | 44.7 |

| 2024 | 51.2 |

| 2025-Q1 | 10.3 |

How tariffs can impact trade

Import duty makes goods expensive in the importing country. This could price out Indian goods from US markets. But the final impact on Indian businesses in any sector will also depend on how it compares with tariffs levied on other nations it competes with. For example, duties on India’s competitor nations such as Bangladesh (20%), Vietnam (20%) and Thailand (19%) are lower, making items imported from there much cheaper in US markets, prompting American buyers to pivot to these markets.

Oil holds near six-week high as US targets Russia, Iran trade

Oil steadied after closing at the highest in almost six weeks as President Donald Trump threatened to penalize India for buying Russian crude and his administration tightened a crackdown on supplies from Iran.

Brent traded above $73 a barrel and is up almost 7% so far this week, while West Texas Intermediate was near $70. The US president said he would impose a tariff on India’s exports and a penalty for its energy purchases from Russia from Aug. 1. He later added that the two sides were still in talks.

It’s unclear what the penalty is, and India’s refiners are seeking clarity from the government in New Delhi. Trump threatened tariffs on Moscow this week unless there’s a swift truce to the war in Ukraine, which his advisers have cast as secondary sanctions on countries buying Russian oil.

Trump’s Tariff puts these 7 Indian stocks on the radar

A new trade curveball from the White House is shaking up investor sentiment in India. The recent news flow indicates that the tariff implementation has now been deferred to August 7. Pharma, textile, and auto are among the key sectors that the street is watching out for, in terms of potential impact.

7 stocks to watch

- Navin Fluorine

- PI Industries

- SRF

- Balkrishna Industries

- Ramkrishna Forgings

- Reliance Industries

- Waaree Energies

Global market reaction

Asian markets did not take the news lightly on 1st Aug 2025. Japan’s Nikkei dropped 0.6%, South Korea’s KOSPI plunged 3.2%, while Taiwan and Australia also reported declines. Interestingly, the Hang Seng Index in Hong Kong managed to inch up 0.2%.

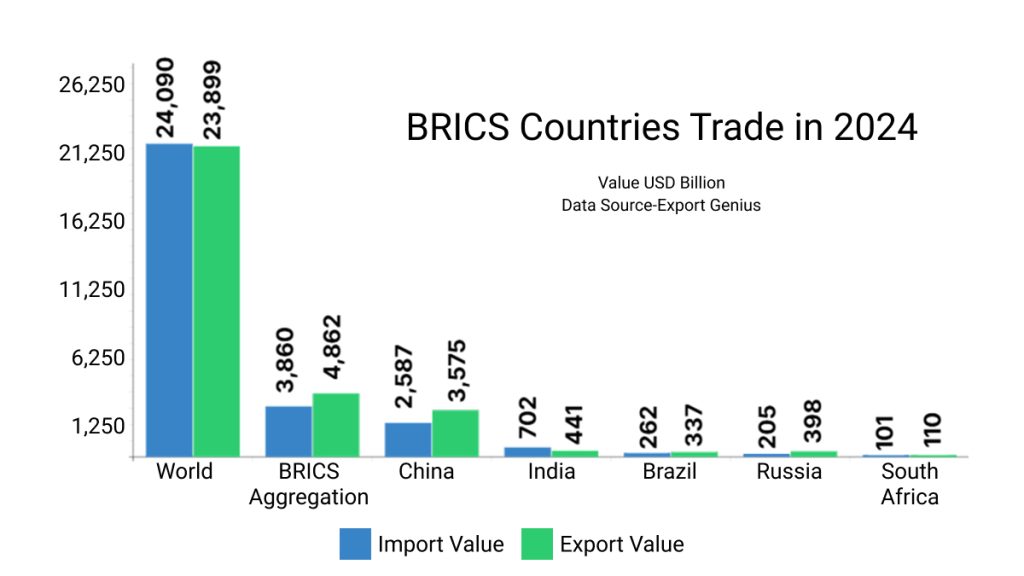

Trump says open to negotiating with India but links tariff ‘penalty’ to BRICS membership

Following his announcement of a 25% tariff rate on India and a ‘penalty’, U.S. President Donald Trump said that his administration is ready to negotiate with India. At the same time, Trump linked India’s membership to the BRICS group of countries as a reason for the penalty.

| Importers/Exporters | Import Value | Export Value |

| World | 24,090 | 23,899 |

| BRICS Aggregation | 3,860 | 4,862 |

| China | 2,587 | 3,575 |

| India | 702 | 441 |

| Brazil | 262 | 337 |

| Russia | 205 | 398 |

| South Africa | 101 | 110 |

*****Value USD Billion

U.S.-Pakistan oil pact sidelines India: What’s behind the move?

After announcing a 25 per cent ‘reciprocal tariff’ on India, plus a penalty for buying Russian weapons and oil, the US had struck a trade deal with Pakistan, including plans to develop its “massive” oil reserves.

What does this mean for India?

Unclear.

India’s oil reserves are far greater – around 4.8 billion barrels proven as of 2016 – and it can extract and refine crude from deep-sea reserves, something Pak does not.

And India produces, on its own, more crude per day than Pakistan; in February 2025, for example, India produced over 600,000 barrels per day, or BPD, and Pak produced only 68,000.

But both rely heavily on imports, India more so because it is a larger and thirstier market.

India has more reserves and produces more crude per day than Pak. But it also needs more, much more. The International Energy Agency predicts an increase of 330,000 BPD this year.

For Pak that figure is set to cross 300,000 BPD in this calendar year.

Bottom Line

As Trump’s trade strategy veers into unpredictable territory, the implications for South Asia and global commerce are becoming harder to ignore. India faces tough decisions ahead, while Pakistan navigates a rare moment of favor. For businesses, analysts, and policymakers, this turbulence isn’t just political—it’s economic, with real impacts on trade flows, tariffs, and strategic partnerships.

In such uncertain times, access to reliable trade intelligence is essential. Export Genius offers up-to-date global trade data and insights to help you stay ahead of policy shifts, identify market opportunities, and make informed decisions.

Stay informed. Stay competitive. Trust Export Genius for clarity in a chaotic trade landscape.