The United States of America is expected to boost coal exports to India after China imposed tariffs on energy imports from the U.S. The move will potentially erode Australian and Russian market shares in the Indian market. Currently, most coal shipments arrive from Australia, followed by Russia, and Indonesia. How will the scenario impact the US, India, and China coal markets? This article explains everything!

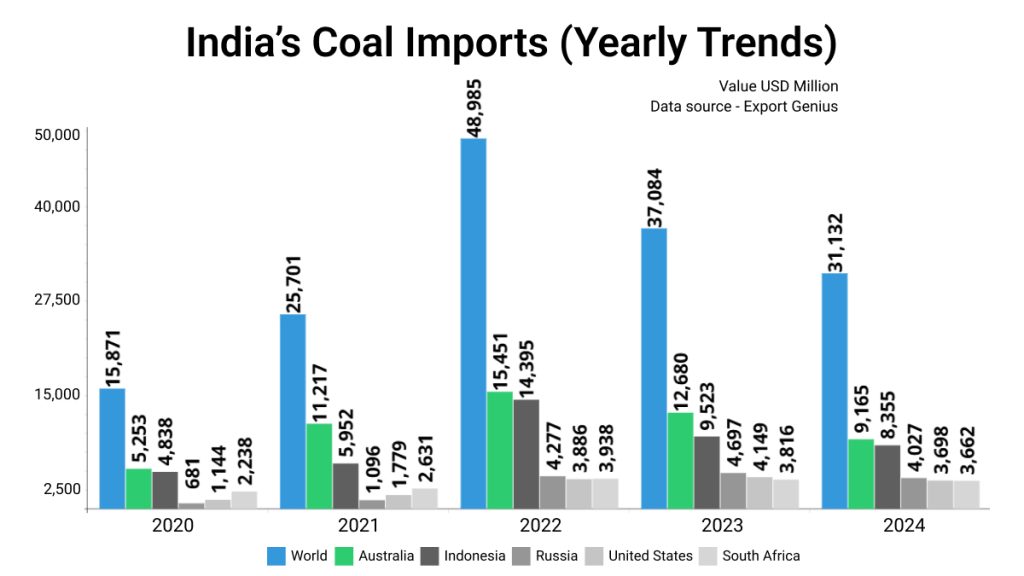

Firstly, we must understand India’s coal dependency on other countries. India’s coal imports increased from USD 15 billion in 2020 to USD 48 billion in 2022. The value of coal shipments declined to USD 37 billion in 2023. Australia, Indonesia, and Russia were the top import sources of coal these years. This trade data is visualized here.

| India’s Coal Imports | 2020 | 2021 | 2022 | 2023 | 2024 |

| World | 15,871 | 25,701 | 48,985 | 37,084 | 31,132 |

| Australia | 5,253 | 11,217 | 15,451 | 12,680 | 9,165 |

| Indonesia | 4,838 | 5,952 | 14,395 | 9,523 | 8,355 |

| Russia | 681 | 1,096 | 4,277 | 4,697 | 4,027 |

| United States | 1,144 | 1,779 | 3,886 | 4,149 | 3,698 |

| South Africa | 2,238 | 2,631 | 3,938 | 3,816 | 3,662 |

******Value USD Million

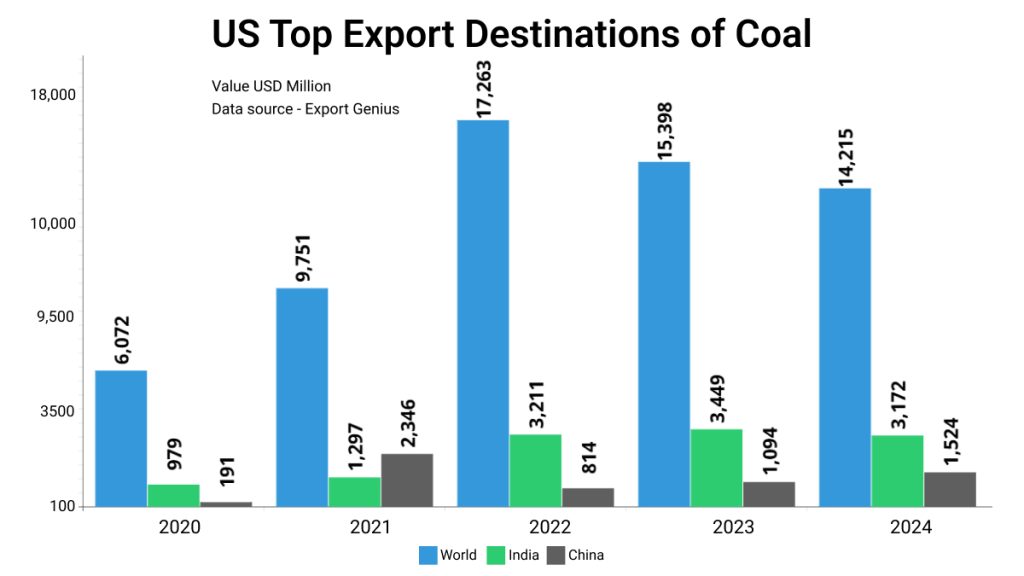

US Top Export Destinations of Coal

China has levied a 15 percent tariff on imports of U.S. coal, which could push U.S. miners to ship to India. India is the world’s second-largest coal importer behind China. According to reports, three U.S. cargoes that were supposed to go to China have landed in India and around 10 more cargoes are waiting.

In volume terms, the US accounts for a small part of Chinese imports of coal. However, the value of coking coal shipments used mainly by steelmakers increased by nearly a third to $1.84 billion in 2024.

| US Coal Exports | 2020 | 2021 | 2022 | 2023 | 2024 |

| World | 6,072 | 9,751 | 17,263 | 15,398 | 14,215 |

| India | 979 | 1,297 | 3,211 | 3,449 | 3,172 |

| China | 191 | 2,346 | 814 | 1,094 | 1,524 |

*****Value USD Million

Australia was the dominant coking coal supplier to India in the last decade. It accounted for about 80 percent of all such shipments. Its value share dwindled to 62 percent in 2024, as supplies from the US as well as Russia and Mozambique helped India to diversify.

Australia could now regain some share in China. Its main market where it made up over two-thirds of coking coal imports before China announced an unofficial ban on such imports in 2021. Mongolia and Russia are currently the biggest exporters of coking coal to China.

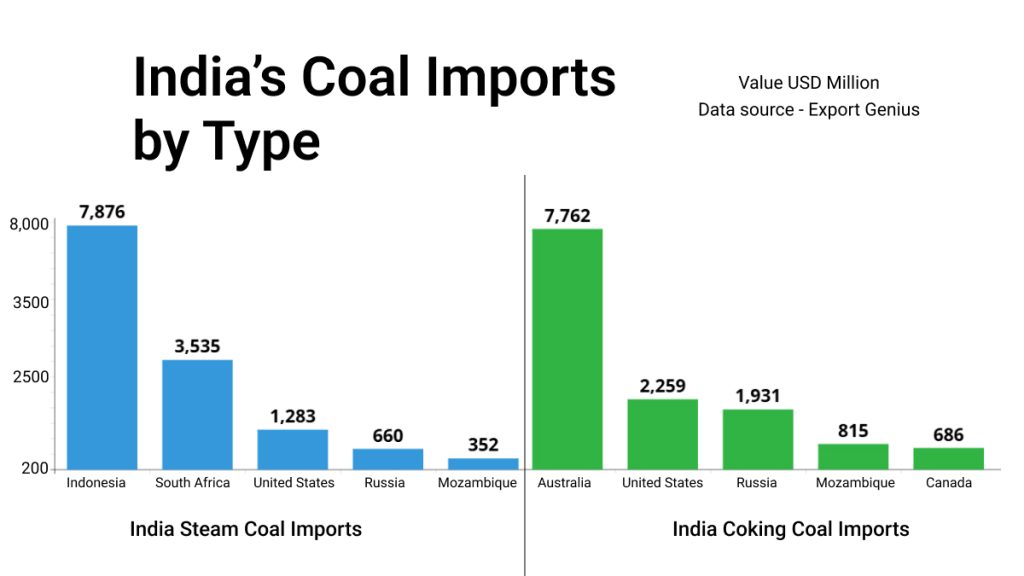

India’s Coal Imports by Type

What type of coal India imports from the world? India is highly dependent on imports of steam and coking coal. India imported steam coal worth USD 14,299 million from the world in 2024. India’s top import sources of steam coal in 2024 were Indonesia (55%), South Africa (24%), the United States (8%), Russia (4%), and Mozambique (2%).

India’s coking coal imports totaled USD 13,985 million in 2024. The top import sources were Australia (55%), the United States (16%), Russia (13%), Mozambique (5%), and Canada (4%).

| India Steam Coal Imports | Value USD Million | India Coking Coal Imports | Value USD Million |

| Indonesia | 7,876 | Australia | 7,762 |

| South Africa | 3,535 | United States | 2,259 |

| United States | 1,283 | Russia | 1,931 |

| Russia | 660 | Mozambique | 815 |

| Mozambique | 352 | Canada | 686 |

India is the net importer of coal, while Australia is the next exporter of coal. At Export Genius, you can access global trade data of coal with actual shipment records. This will help you understand the business dynamics of coal. Get all updates on how China’s tariff would change the market scenario of coal imported by India and other countries. In addition, you can also analyze rising trends in US coal exports from US export data.