As geopolitical tensions continue to escalate, the international community is preparing for a new round of sanctions targeting Russia. While the precise scope of these sanctions is still unfolding, their implications for global shipping and logistics are already being widely anticipated — and scrutinized.

From tanker reroutes to insurance restrictions and compliance risks, these new measures could significantly reshape global maritime flows in ways that extend far beyond Russia’s borders.

What’s Driving the Next Wave of Sanctions?

The upcoming sanctions are largely in response to Russia’s ongoing military activities and its tightening relationships with sanctioned regimes. These measures are expected to target:

- Energy exports, particularly crude oil and refined products.

- Shipping operators and vessels facilitating trade that circumvents existing sanctions.

- Financial channels are tied to maritime insurance and trade finance.

- Technology and dual-use goods relevant to shipbuilding or logistics infrastructure.

- With more aggressive enforcement tools and expanded blacklists, the next wave aims to close loopholes left open by previous rounds.

Key Impacts on the Shipping Industry

Rerouting and Longer Transit Times

As more ports and waters become off-limits for sanctioned vessels or commodities, cargo will increasingly shift to longer and costlier trade routes. This includes:

- Tankers are avoiding the Suez Canal or European ports.

- Russian cargo is diverted to Asia, particularly China and India.

- Result: Higher fuel costs, longer lead times, and increased congestion in alternative trade corridors.

Shadow Fleet Expansion and Enforcement Risks

Russia has been increasingly reliant on a so-called “shadow fleet” — a network of aging vessels operating under opaque ownership and flags of convenience — to keep oil exports flowing.

New sanctions will likely target these vessels more aggressively, possibly through:

- Vessel tracking bans

- Stricter flag-state compliance

- Insurer blacklisting

- Risk: Legitimate carriers may be inadvertently entangled with sanctioned operations, resulting in reputational and legal consequences.

Insurance & Financial Services Disruption

Sanctions on insurers and banks involved in Russian trade could disrupt:

- Protection and indemnity (P&I) insurance for tankers.

- Trade credit and letters of credit for shipments.

- Without proper coverage, many ports may deny access to vessels, halting operations even before cargo reaches its destination.

Port Operations and Customs Delays

Expect more customs checks, delays, and even cargo seizures in regions enforcing the sanctions strictly, particularly:

- The EU, UK, and US

- Allied countries participating in sanction coalitions (e.g., Japan, Australia).

- Logistics implication: Higher clearance times, increased document scrutiny, and additional costs for compliance verification.

How Should Businesses and Carriers Respond?

With enforcement tightening, shipping companies, freight forwarders, and international traders should take immediate steps:

- Strengthen Due Diligence: Screen vessels, shippers, and cargo origins through enhanced compliance software.

- Monitor Regulatory Updates: Stay tuned to OFAC (US), EU, and UK sanctions lists and guidance.

- Review Charter Party Agreements: Add sanctions clauses to protect against sudden trade route disruptions.

- Diversify Routes and Partners: Work with compliant and transparent partners in neutral or allied jurisdictions.

Global Implications: Beyond Russia

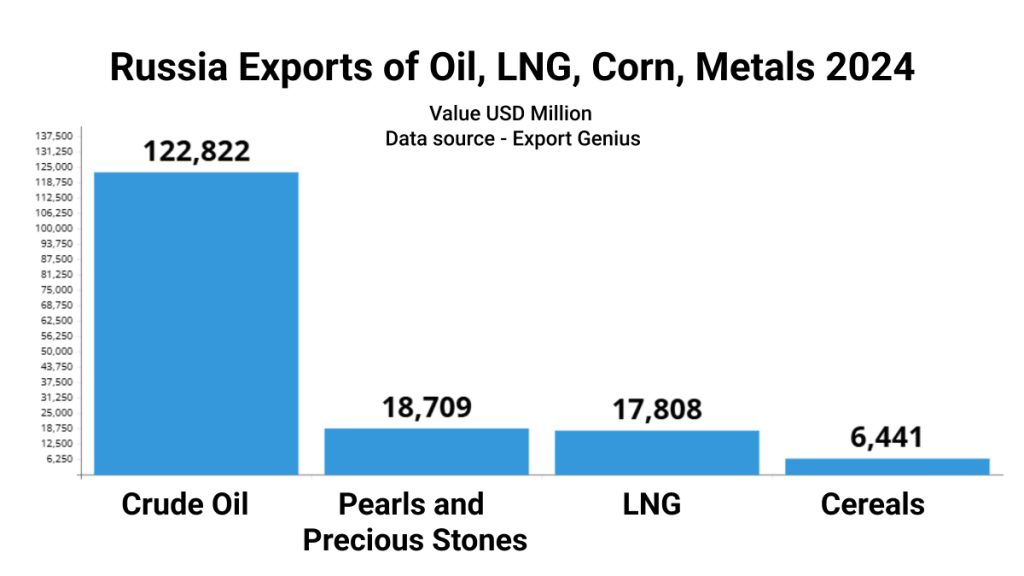

The ripple effects will likely extend beyond Russian trade alone. Sanctions enforcement could strain global capacity and increase freight volatility — particularly in oil, LNG, agricultural commodities, and metals.

| Commodity | Value USD Million |

| Crude Oil | 122,822 |

| Pearls and Precious Stones | 18,709 |

| LNG | 17,808 |

| Cereals | 6,441 |

Countries heavily reliant on Russian exports (e.g., in Africa or South Asia) may face supply chain delays or turn to alternate partners, reshaping trade flows globally.

| Country | Value USD Million |

| China | 93,980 |

| India | 47,637 |

| Turkey | 39,731 |

| Egypt | 7,284 |

| Brazil | 7,189 |

| South Korea | 6,972 |

| Uzbekistan | 5,894 |

| Singapore | 4,421 |

| Japan | 4,111 |

The Bottom Line

The next round of sanctions on Russia is not just a political maneuver — it’s a tectonic shift in the rules governing maritime trade. As regulators close in on loopholes and expand enforcement, the global shipping industry must adapt quickly.

Proactive compliance, operational agility, and strategic planning will be essential to weather the challenges ahead and maintain trust in increasingly uncertain waters.