The Iran-Israel war is full-blown with media reports pointing to an imminent attack on Israel despite earlier assessments that Tehran might be considering the plan. The attacks threaten a negative impact beyond the region, especially in nearby South Asia, which has historical, cultural, religious, and economic ties with the Middle East. Heightened geopolitical tensions may prompt businesses to reassess sourcing strategies and supply chain resilience. As a result, there could be a shift in supplier bases towards regions perceived as less susceptible to instability.

What?

Iran and Israel conflict escalated to a brief period of direct confrontation between the two countries.

Why?

Since the July 31 assassination of Hamas leader Ismail Haniyeh in Tehran, Iran has been threatening to avenge his death by attacking Israel. That has sent shockwaves throughout the Middle East, and the feeling that the Iranians are likely to respond with an attack on Israel that could start an all-out regional war.

When?

Iran-Israel conflict started on 1st April 2024. Locations: Israel, Iran, Iraq, Lebanon, Syria, Jordan, Yemen, Red Sea, West Bank, Strait of Hormuz, and Mediterranean Sea.

Impact?

The impact of the widening of the Gaza war would be especially severe for South Asian nations. As the Arabian Gulf is the world’s biggest oil producing region, if a full-scale war breaks out, where the animosity between Saudi Arabia and Iran also aggravates. It would jack up oil prices to unimaginable levels and may also affect the flow of goods through the Suez Canal.

Middle-East and Asia

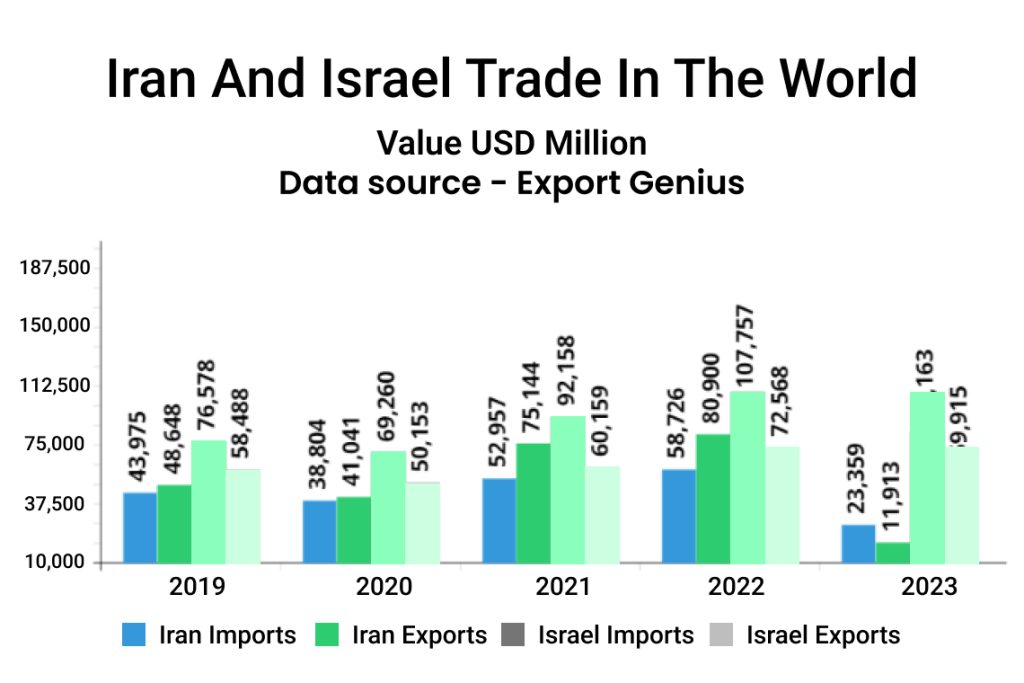

Iran and Israel are one of the major trade countries in the Middle East. Asian countries are majorly dependent on them for import of crude oil and other commodities. Here is a look at Iran and Israel’s trade in the world.

| Year | Iran Imports | Iran Exports | Israel Imports | Israel Exports |

| 2019 | 43,975 | 48,648 | 76,578 | 58,488 |

| 2020 | 38,804 | 41,041 | 69,260 | 50,153 |

| 2021 | 52,957 | 75,144 | 92,158 | 60,159 |

| 2022 | 58,726 | 80,900 | 107,757 | 72,568 |

| 2023 | 23,359 | 11,913 | 83,163 | 59,915 |

Major commodities Iran exports to the world include – plastics, ores, slag & ash, mineral fuels & oils, organic chemicals, iron & steel, and edible fruits and nuts. Israel’s top exports to the world are electrical machinery & equipment, optical, photographic, medical equipment, pearls & precious stones, machinery, mechanical appliances, etc. and mineral fuels & oils.

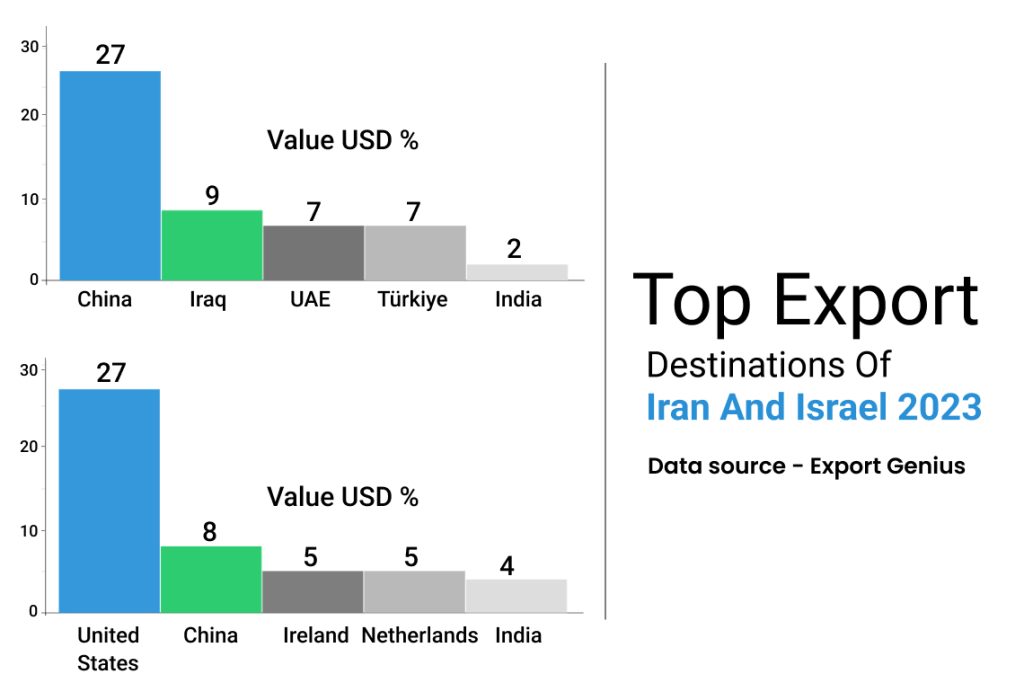

The top export destinations of Iran and Israel are countries in Asian continent. China is the biggest importer of goods from both the countries. India stood at the 5th position in the list of Iran and Israel export destinations in 2023. Data visualization will give you a clear picture of which countries in the world are majorly dependent on Iran and Israel for imports of goods.

| Iran’s Export Destinations | Value USD % | Israel’s Export Destinations | Value USD % |

| China | 27 | United States | 27 |

| Iraq | 9 | China | 8 |

| United Arab Emirates | 7 | Ireland | 5 |

| Türkiye | 7 | Netherlands | 5 |

| India | 2 | India | 4 |

The Middle-East is the destination for a large chunk of the exports of South Asian states and that would also suffer. The combination of higher oil prices and lower remittances and exports revenues would affect the balance of payments of all SAARC countries.

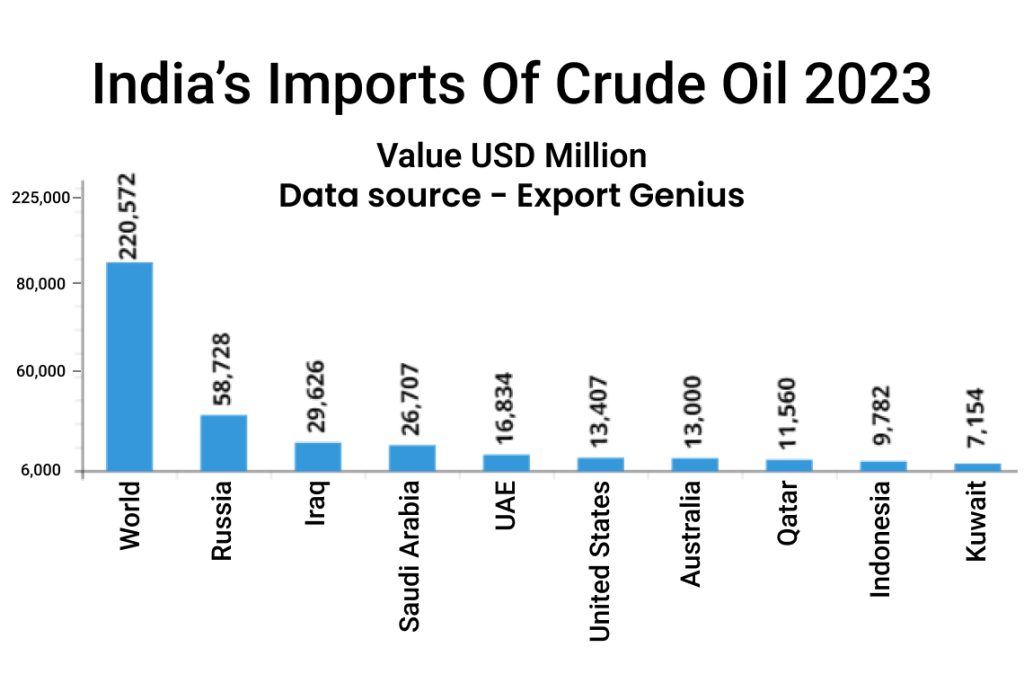

For India, the biggest impact of the turmoil is being felt on its stock market. The growing conflict between Israel and oil-rich Iran could potentially disrupt oil supply from the region, leading to an increase in oil prices globally. Look on India’s imports of crude oil from the world, mainly from Middle East.

| Crude Oil Import Sources of India in 2023 | Value (USD Million) |

| World | 220,572 |

| Russia | 58,728 |

| Iraq | 29,626 |

| Saudi Arabia | 26,707 |

| United Arab Emirates | 16,834 |

| United States | 13,407 |

| Australia | 13,000 |

| Qatar | 11,560 |

| Indonesia | 9,782 |

| Kuwait | 7,154 |

Bangladesh too has close ties with Iran and Saudi Arabia, which is the second-largest source of remittance for the nation. Bangladesh is facing double challenge – severe economic crisis as unrest hits businesses and Iran-Israel attack.

The conflict has impacted trade routes between Asia and the Middle East. If it surges ahead, it could further impact trade by the important maritime passage – the Strait of Hormuz. A disturbance here could lead to instability, increased shipping costs, and delays in global trade.

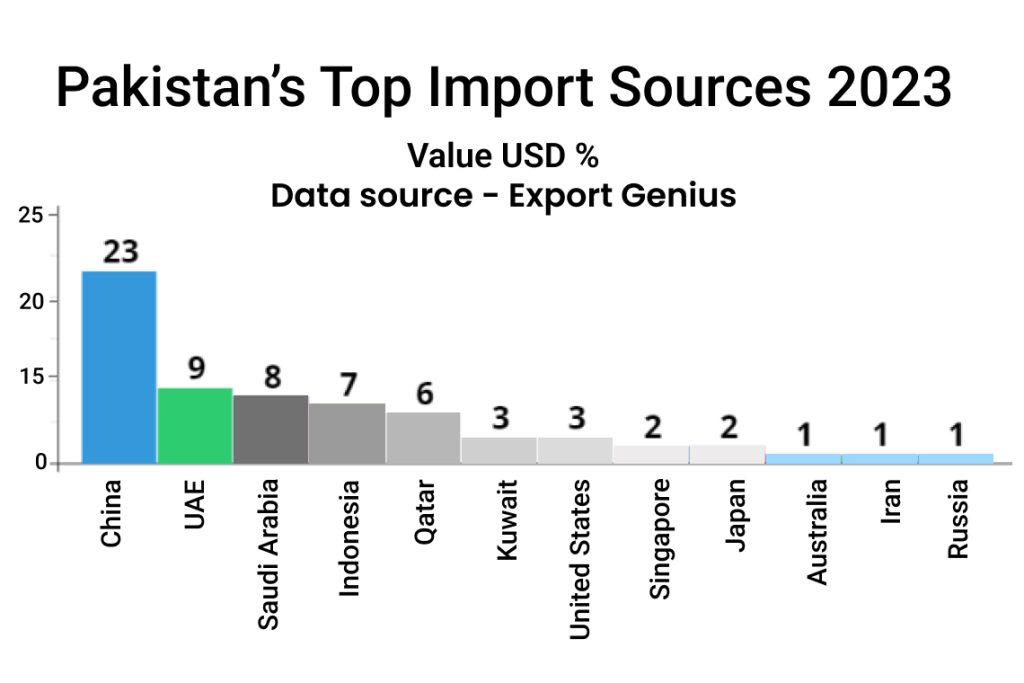

The impact will be particularly severe for Pakistan, which shares a border with Iran, while it shares very close ties with Saudi Arabia. It is the biggest source of much-needed foreign remittances as well as major export destination. Here is a look at which countries supply goods to Pakistan and the ongoing conflict in the Middle East may disrupt the flow of shipments.

| Pakistan’s Top Import Sources in 2023 | Value USD (%) |

| China | 23 |

| United Arab Emirates | 9 |

| Saudi Arabia | 8 |

| Indonesia | 7 |

| Qatar | 6 |

| Kuwait | 3 |

| United States | 3 |

| Singapore | 2 |

| Japan | 2 |

| Australia | 1 |

| Iran | 1 |

| Russia | 1 |

What about logistics?

The ongoing tension between Iran and Israel has significant implications for international trade, particularly from the standpoint of logistics and maritime operations. Almost 80-85 percent of the global cargo transported by ships, the shipping company most likely to face the heat. The Strait of Hormuz, a critical waterway through which a significant portion of the world’s oil passes, is located near Iran. Any escalation in hostilities could lead to disruptions in oil shipments, impacting global energy markets and driving up shipping costs.

Similarly, the Red Sea, another vital maritime route, could be affected by tensions between Iran and Israel, potentially impacting trade between Africa, Asia, and Europe. Moreover, sustained conflict could lead to a surge in crude oil prices, directly impacting various commodity prices. Logistics providers and shipping companies are actively monitoring the situation and implementing contingency plans to mitigate risks associated with the conflict.

In conclusion, the Iran-Israel conflict poses significant challenges for global trade, particularly from the perspectives of logistics and maritime operations.